GBP/USD Analysis and Charts

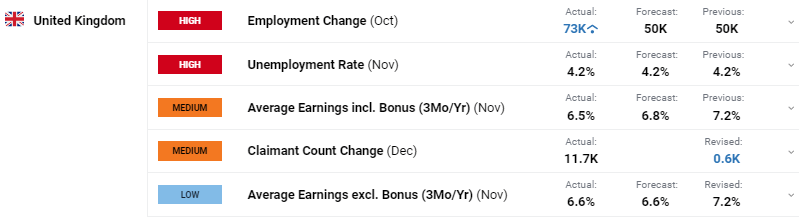

- Falling UK wages will cheer the BoE.

- Cable is under pressure from the US dollar .

UK wage growth slowed in November, according to the latest Office for National Statistics (ONS) data, while the unemployment rate remained unchanged. While wage growth continues to fall, it remains too high for the Bank of England to consider any imminent UK rate cut .

For all market-moving economic data and events see the

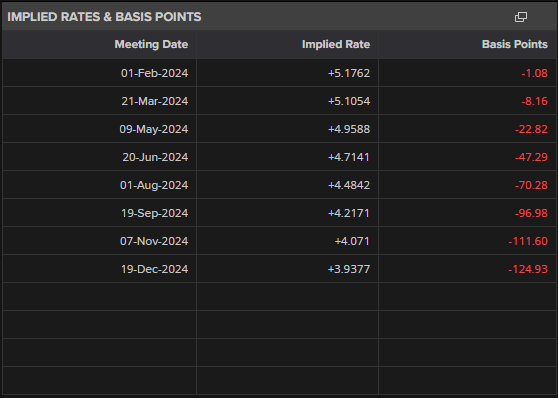

The latest UK implied rates show the first UK Base Rate cut is seen in May with a total of 131 basis points of cuts predicted for next year.

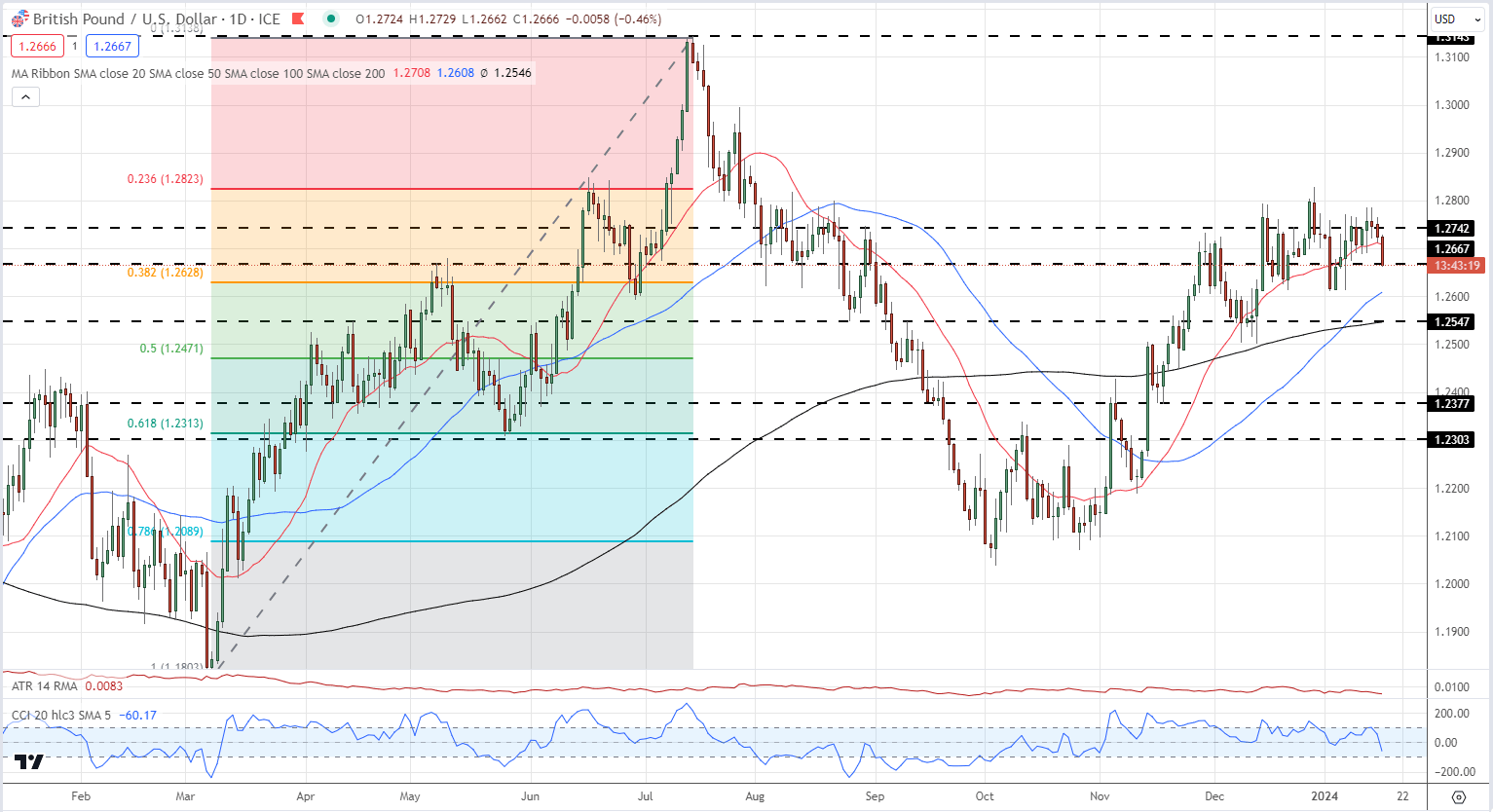

The US dollar has returned from a long weekend on the front foot and is pushing higher. The US dollar index is at a 10-day high, aided in part by slightly higher US Treasury bond yields and ongoing geopolitical worries in Ukraine and the Red Sea. This dollar strength is pushing cable into a support level around 1.2667, and if this is broken then the 38.2% Fibonacci level at 1.2628, a cluster of prior lows around 1.2610/15, and the 50-day simple moving average at 1.2608 will all come into play. A move higher would see 1.2742 act as resistance ahead of a cluster of recent highs up to just under 1.2800.

GBP/USD Daily Price Chart

Retail trader GBP/USD data show 49.18% of traders are net-long with the ratio of traders short to long at 1.03 to 1.The number of traders net-long is 20.81% higher than yesterday and 13.71% higher than last week, while the number of traders net-short is 6.02% lower than yesterday and 12.71% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP / USD prices may continue to rise.