US DOLLAR FORECAST – EUR/USD & GBP/USD

- The U.S. dollar rises after U.S. inflation data surprises to the upside and unemployment claims fall to lowest level in nearly three months

- With consumer prices running above target and the U.S. labor market still firing on all cylinders, the Fed may be reluctant to cut rates prematurely

- This article focuses on the technical outlook for EUR/USD and GBP/USD , examining critical price levels following the U.S. CPI report.

The U.S. dollar, as measured by the DXY index, advanced 0.3.% on Thursday in a volatile trading session following the release of two key U.S. economic reports: the December inflation survey and weekly jobless claims data.

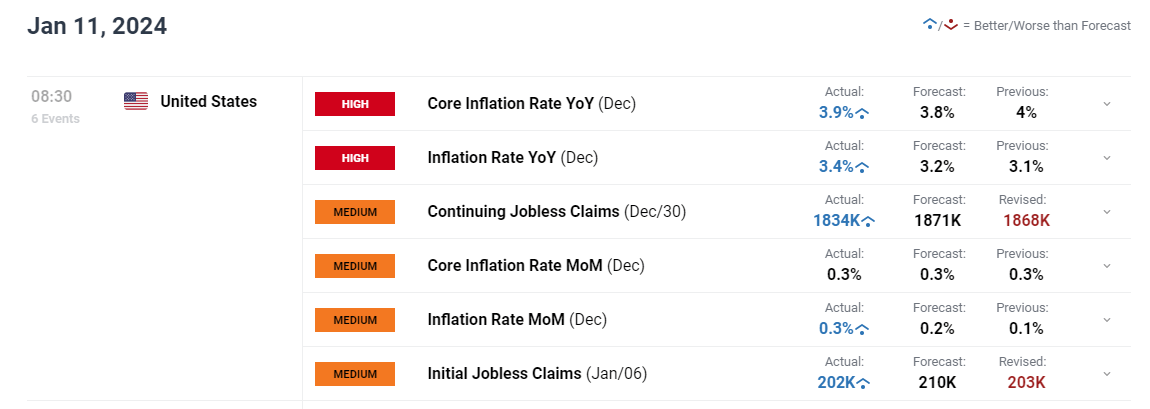

For context, headline CPI from last month surprised on the upside, coming in at 3.4% y-o-y, versus the 3.2% y-o-y expected. The core gauge also exceeded forecasts, clocking in at 3.9% - one tenth of a percent above consensus estimates .

Elsewhere, applications for jobless benefits sank to the lowest level in nearly three months last week, indicating that mass layoffs are not yet occurring and that hiring is probably continuing at a good pace, a sign that the labor market is still firing on all cylinders despite the late stage of the business cycle.

US ECONOMIC DATA

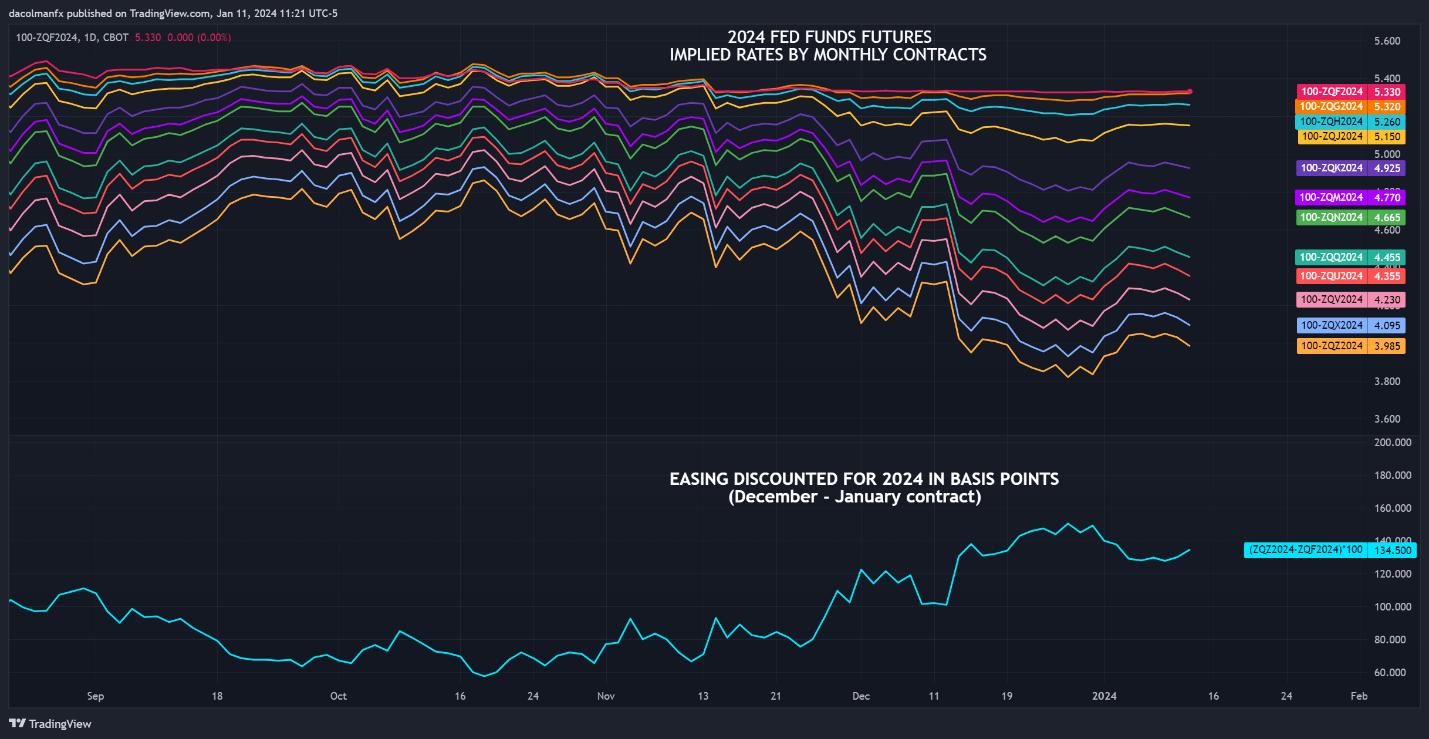

With consumer prices well above the 2.0% target and a labor market displaying exceptional resilience, the Federal Reserve will be reluctant to cut interest rates sharply, contravening Wall Street ’s expectations calling for 135 basis points of easing this year.

For clues on the outlook for monetary policy , it is important to keep an eye on Fedspeak in the coming days and weeks. In light of recent developments, traders should not be surprised if central bank rhetoric begins to lean in a more hawkish direction, a scenario that should be bullish for yields and the U.S. dollar.

2024 FED FUNDS FUTURES IMPLIED RATES

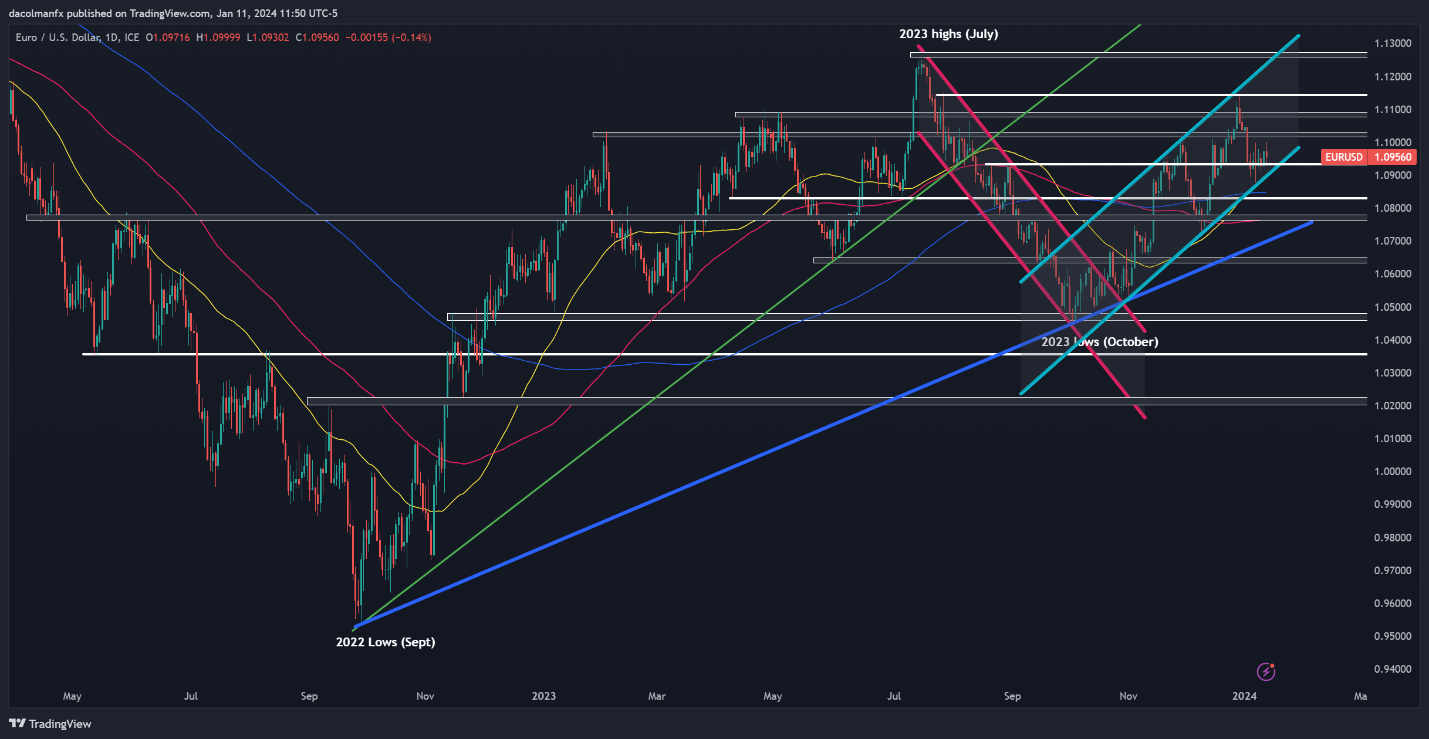

EUR/USD TECHNICAL ANALYSIS

EUR/ USD retreated on Thursday but managed to remain above technical support at 1.0930. If this floor holds, the pair could resume its upward journey in the coming days, setting the stage for a move towards 1.1020. On continued strength, attention will shift to 1.1075/1.1095, followed by 1.1140.

On the flip side, if bearish momentum accelerates and the exchange rate slips below 1.0930, a retracement towards 1.0875 may occur - a region where the 50-day simple moving average aligns with the lower limit of a short-term ascending channel. Further weakness could lead to a retest of the 200-day SMA.

EUR/USD TECHNICAL CHART

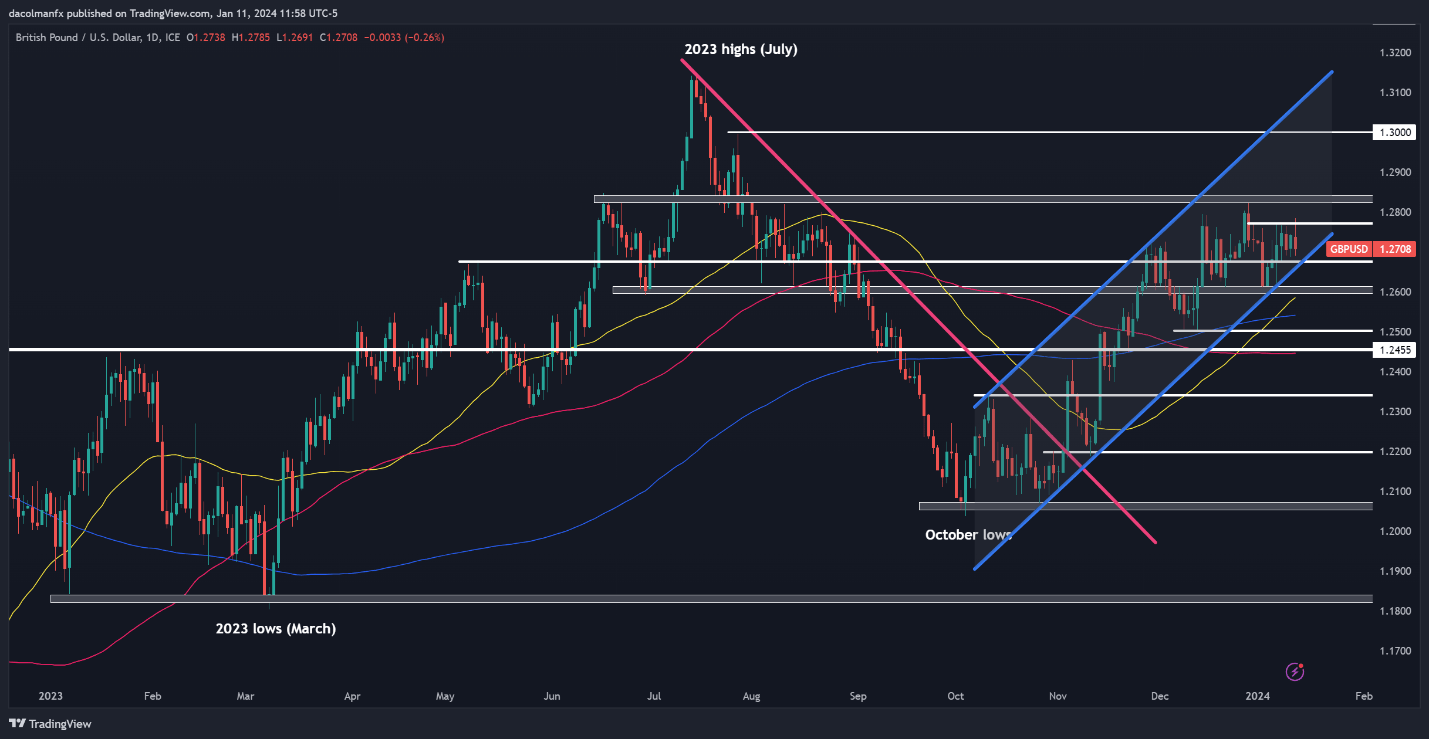

GBP/USD TECHNICAL ANALYSIS

GBP/USD weakened on Thursday but held above channel support near 1.2675. The bulls must protect this technical floor at all costs; failure to do so could trigger a pullback towards the 1.2600 handle. Subsequent losses from this point onward could expose the 200-day simple moving average.

On the other hand, if cable reverses higher and manages to push above resistance at 1.2765, sentiment around the British pound could improve further, creating the right conditions for a climb toward the December highs above the 1.2800 level. Further gains hereon out could facilitate a rally towards 1.3000.

GBP/USD TECHNICAL CHART