POUND STERLING ANALYSIS & TALKING POINTS

- UK CPI falls to 2-year lows.

- BoE forecasts now point to first rate cut in May 2024.

- GBP/USD bearish divergence looks likely.

GBPUSD FUNDAMENTAL BACKDROP

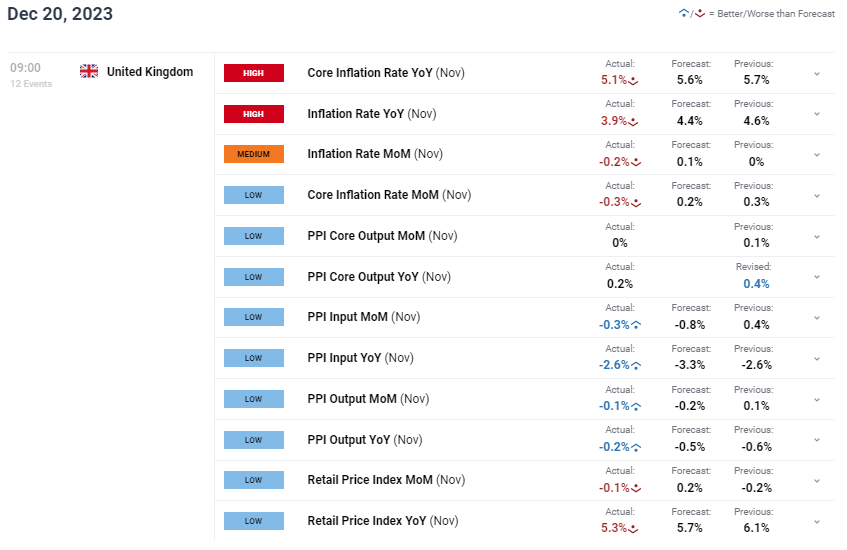

The British pound fell sharply this morning after the UK CPI report showed a significant decline in inflationary pressures on both headline and core metrics respectively (see economic calendar below). The impact of restrictive monetary policy measures is now showing as consumers are reluctant to spend thus decreasing demand for goods and services. Retail sales figures confirm this and should this trend continue, pound upside may be limited.

GBP/ USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Headline inflation is now comparable with levels last seen in September 2021 and has pushed back against recent messaging that UK inflation is more willful than that of its developed counterparts including the euro area and US. According to the Office for National Statistics report, the largest downward contributions stemmed from transport, recreation and culture, and food and non-alcoholic beverages. The UK’s Chancellor Hunt went on to comment that “there is still further to go on inflation, it never declines in a straight line.” The comment was made most likely in an attempt to limit market reaction although many will dismiss his statement and focus on the actual data.

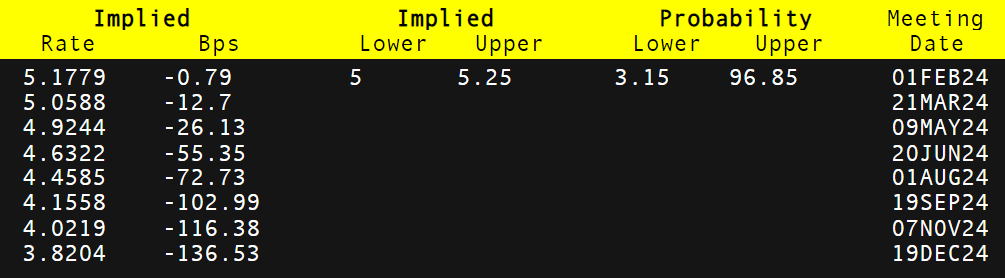

If we turn to markets expectations for Bank of England (BoE) rate path, the dovish repricing has been notable with cumulative interest rate cuts anticipated around by December 2024. The first cut could take place as soon as May 2024 with the possibility of a February cut very much on the cards should this disinflationary trend continue.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

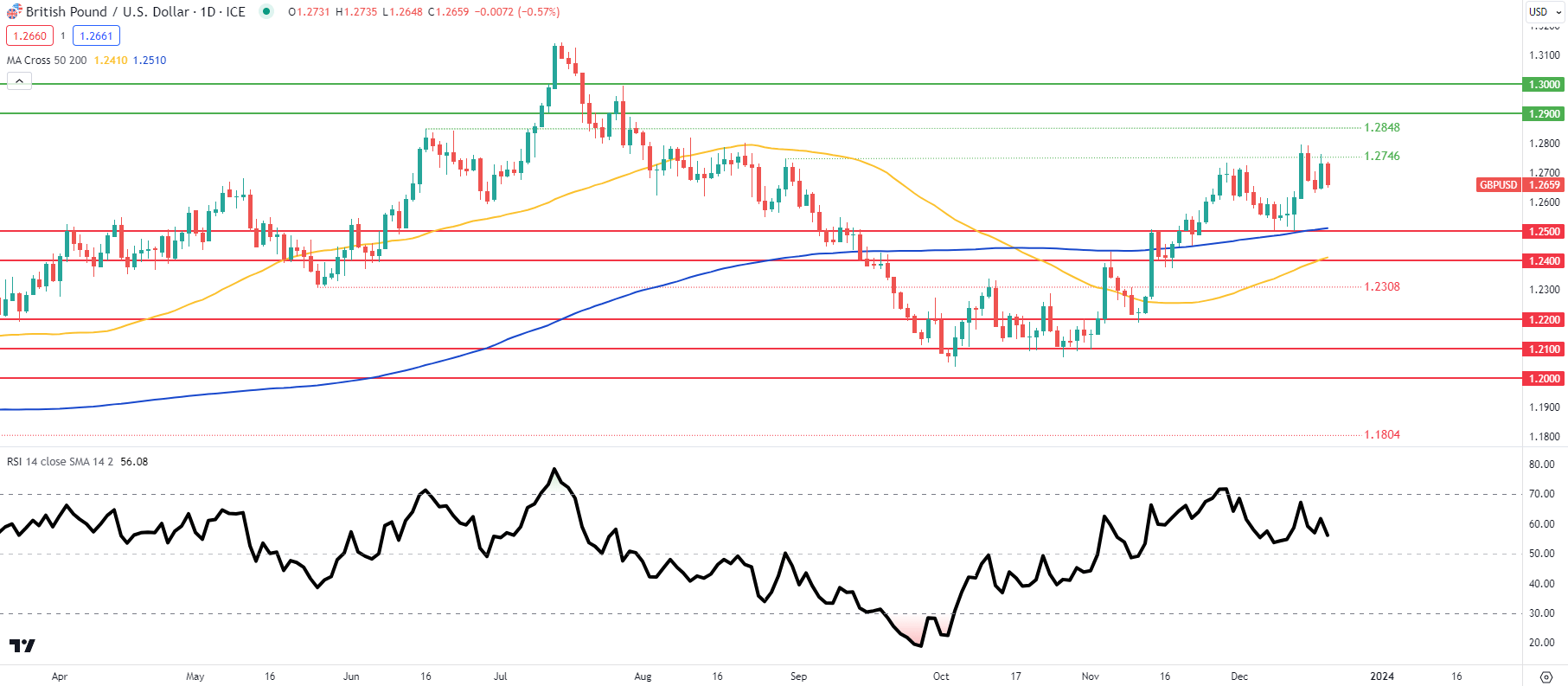

GBP/USD DAILY CHART

Chart prepared by Warren Venketas , IG

Daily GBP/USD price action has been threatening bearish/negative divergence as the Relative Strength Index (RSI) prints lower highs. Cable bears may look to retest the psychological handle/ 200-day moving average (blue) once more considering recent news.

- 1.2900

- 1.2848

- 1.2746

- 1.2500/200-day MA

- 1.2400/50-day MA

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net on GBP/USD with of traders holding SHORT positions (as of this writing).