RAND TALKING POINTS & ANALYSIS

- Improving South African production helps buoy rand.

- Can US CPI influence Fed narrative?

- USD/ZAR rising wedge still in play.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

Start Course

USD/ZAR FUNDAMENTAL BACKDROP

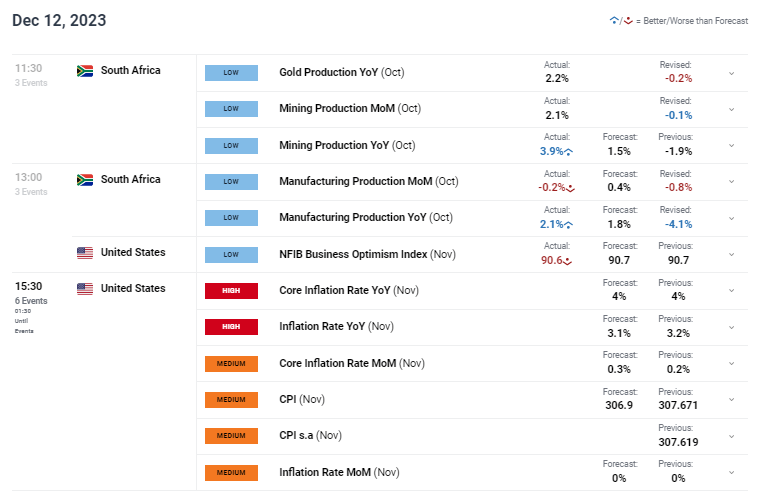

The South African rand kicked off the European session on the front foot on the back of a weaker USD as well as some positive South African specific economic data (see calendar below). Gold , mining and manufacturing production all surprised to the upside YoY for October while markets prepare themselves for the upcoming US CPI report. US inflation has been steadily declining albeit at a slower rate than many Fed officials hoped for but with other economic data showing a declining US economy, markets have ‘ dovishly ’ repriced expectations. This makes today’s CPI critical for short-term guidance especially after last week’s Non-Farm Payroll (NFP) beat. I expect Fed Chair Jerome Powell to pushback against rate cuts tomorrow to allow for more incoming data.

Stronger base and precious metals prices have also contributed to ZAR upside from a commodity export point of view.

USD /ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

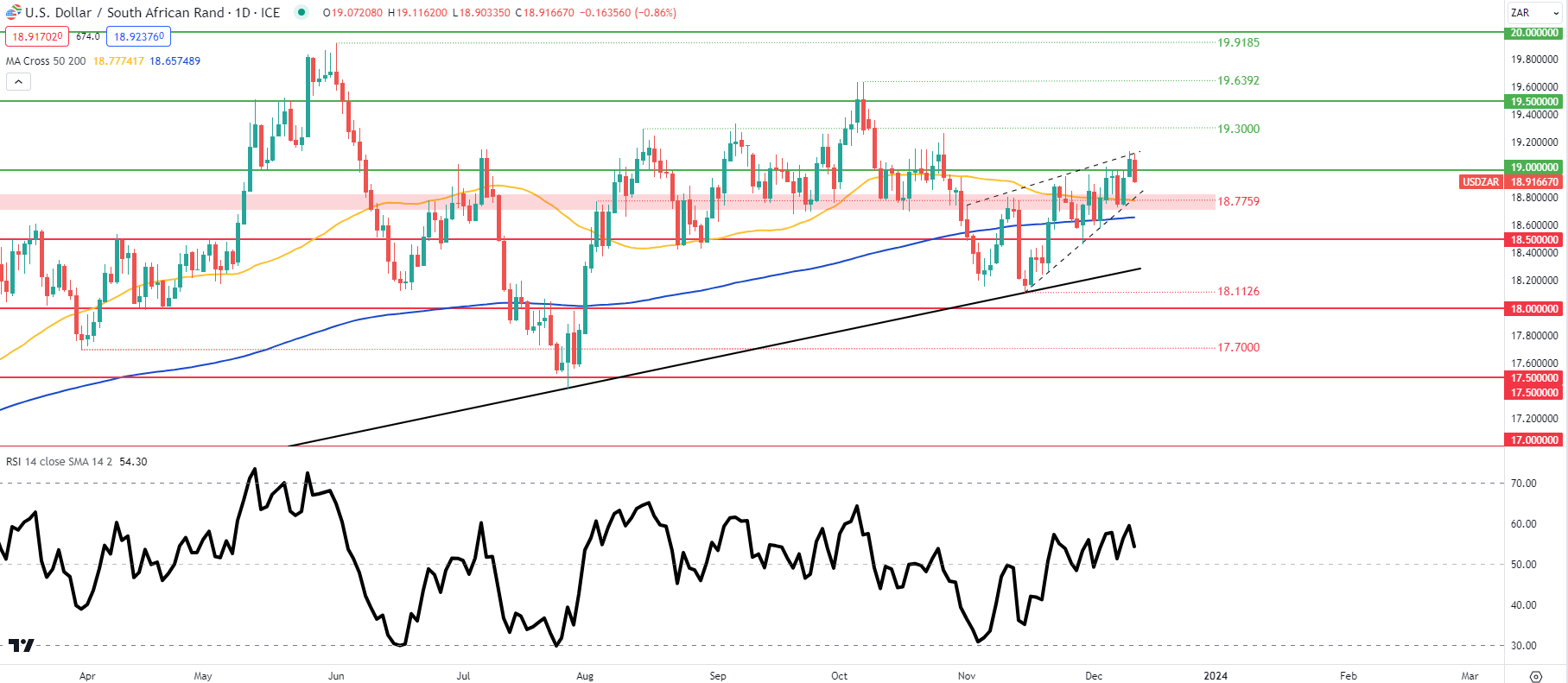

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas , TradingView

The daily USD/ZAR chart continues to develop within the rising wedge chart pattern (dashed black lines) as the pair trades in and around the psychological handle. Traditionally a known as a bearish continuation formation but is highly dependent on US CPI, SA CPI and the Fed. The pattern will be negated should we see a confirmation close above wedge resistance while rand strength could be catalyzed by a US CPI miss thus possibly opening up the support level.

- 19.3000

- 19.0000

- Wedge resistance

- 18.7759/50-day MA (yellow)/Wedge support

- 200-day MA (blue)

- 18.5000