EUR/USD ANALYSIS

- Weak euro area economic data has left the euro vulnerable.

- Will elevated US inflation prompt EUR selloff?

- EUR/USD approaches key support zone.

EURO FUNDAMENTAL BACKDROP

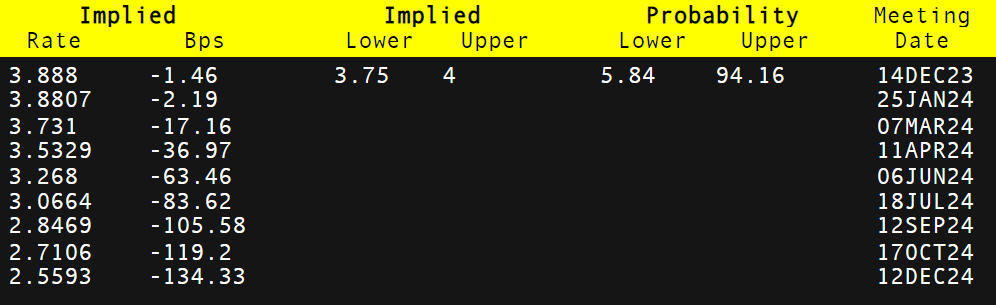

The euro opened the week pretty flat as markets prepare for central bank decisions later this week alongside some supplementary data that could sway the messaging provided by the two central banks. Leading up to these announcements, European Central Bank (ECB) interest rate expectations have been ‘dovishly’ repriced after taking into account eurozone data while the Federal Reserve may be less inclined to rush into heavy rate cuts due to its comparatively more resilient economy. This resilience was reinforced by last week’s Non-Farm Payrolls (NFP) report that highlighted the robust labor market in the US. Money markets currently price in the first ECB cut around March/April next year. From a Fed perspective, Goldman Sachs stated this morning that they expect the Fed to deliver its first rate cut in Q3 2024 vs Q4 2024 in their previous forecast. In summary, the euro area is showing signs of significantly weaker economic data relative to the US and could weigh negatively on the EUR moving forward.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

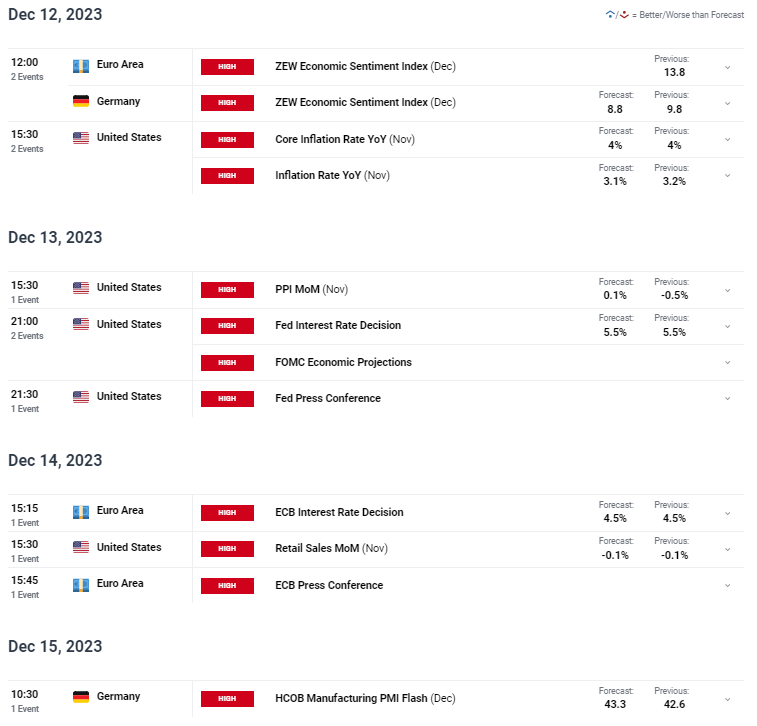

The economic calendar later today does not hold much in terms of market moving information and EUR/ USD is likely to remain around current levels. The week ahead will be focused on US CPI and PPI to give an indication as to the narrative Fed Chair Powell may adopt but the US has the benefit of continuing with a ‘wait and see’ approach while the ECB may be more pressed to loosen monetary policy . Other important data points include ZEW economic sentiment for Germany and the euro area as well as US retail sales and German manufacturing PMI’s .

ECONOMIC CALENDAR (GMT+02:00)

Source: DailyFX Economic Calendar

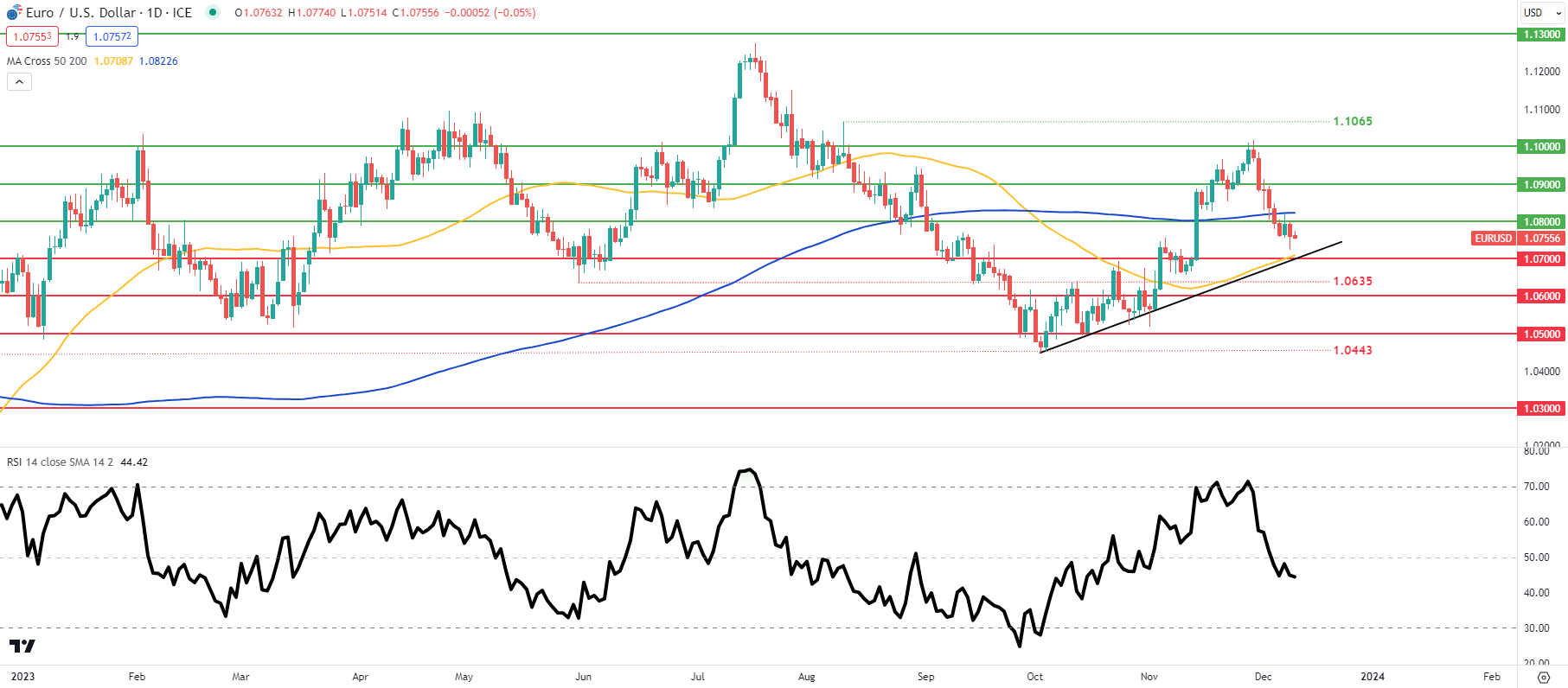

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas , IG

The daily EUR/USD chart above stays below the psychological handle and looks to be heading towards the longer-term trendline support/50-day moving average (yellow). Short-term directional bias could be heavily swayed by US CPI and PPI as mentioned above. EUR/USD traders remain cautious as reflected by the Relative Strength Index (RSI) hovering around its midpoint.

- 1.1000

- 1.0900

- 200-day MA

- 1.0800

- 1.0700/50-day MA/Trendline support

- 1.0635

- 1.0600

IGCS shows retail traders are currently neither on EUR/USD , with of traders currently holding long positions (as of this writing).