KIWI DOLLAR TALKING POINTS AND ANALYSIS

- Fed peak + RBNZ hawkishness supportive of NZD .

- All eyes shift to the US for the rest of the trading week.

- Technical signals point to downside to come.

NEW ZEALAND DOLLAR FUNDAMENTAL BACKDROP

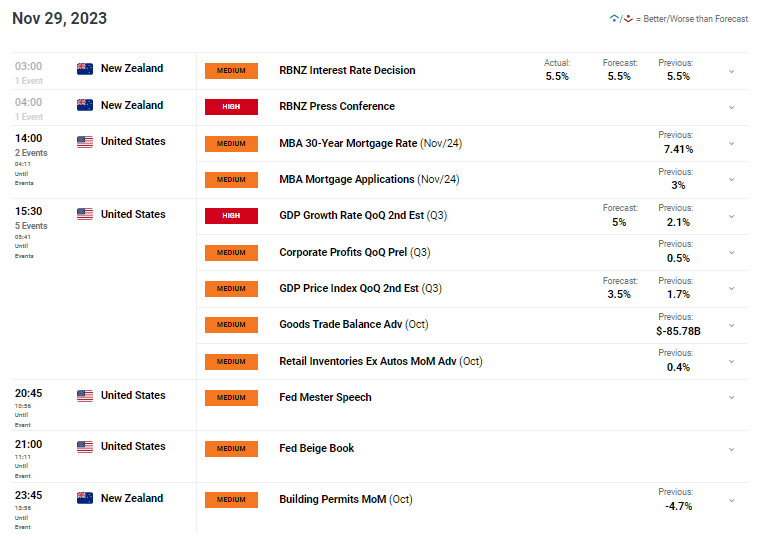

The New Zealand dollar rallied behind a weaker US dollar and the Reserve Bank of New Zealand (RBNZ) interest rate decision earlier this morning. Although the central bank kept rates on hold (see economic calendar below), a rather hawkish and authoritative tone was set by the RBNZ Governor Orr. Some key statements to consider are shown below:

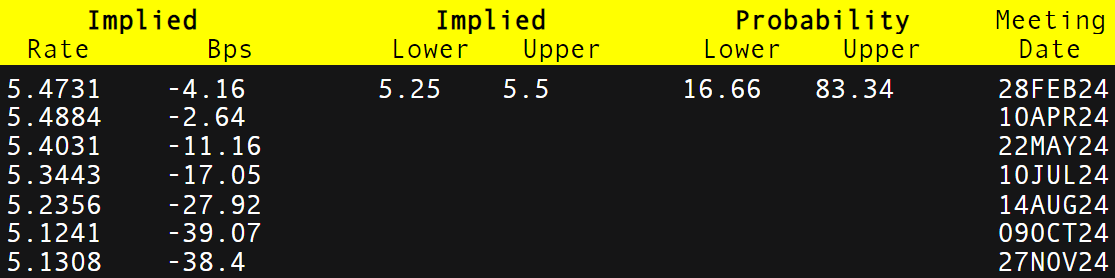

It is clear that money markets do not anticipate any additional rate hikes to come in 2024 but data dependency will be a key driver. If inflation data remains on its upward trajectory, the RBNZ may well take a decisive decision to tighten monetary policy once more.

RBNZ INTEREST RATE PROBABILITIES

Source: Refinitiv

The USD fell sharply yesterday after one of the Fed’s most prominent hawks, Fed’s Williams shifted to a less aggressive tone. Mr. Williams hinted at the possibility of no further rate hikes and rate cuts should inflation continue to fall. Implied Fed funds futures showed a dovish repricing of roughly of cumulative rate cuts by December 2024 with US Treasury yields extending their decline across the curve. Later today, US GDP , additional Fed speakers and the Fed’s beige book will come into focus ahead of tomorrow crucial core PCE print (Fed’s preferred measure of inflation).

ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

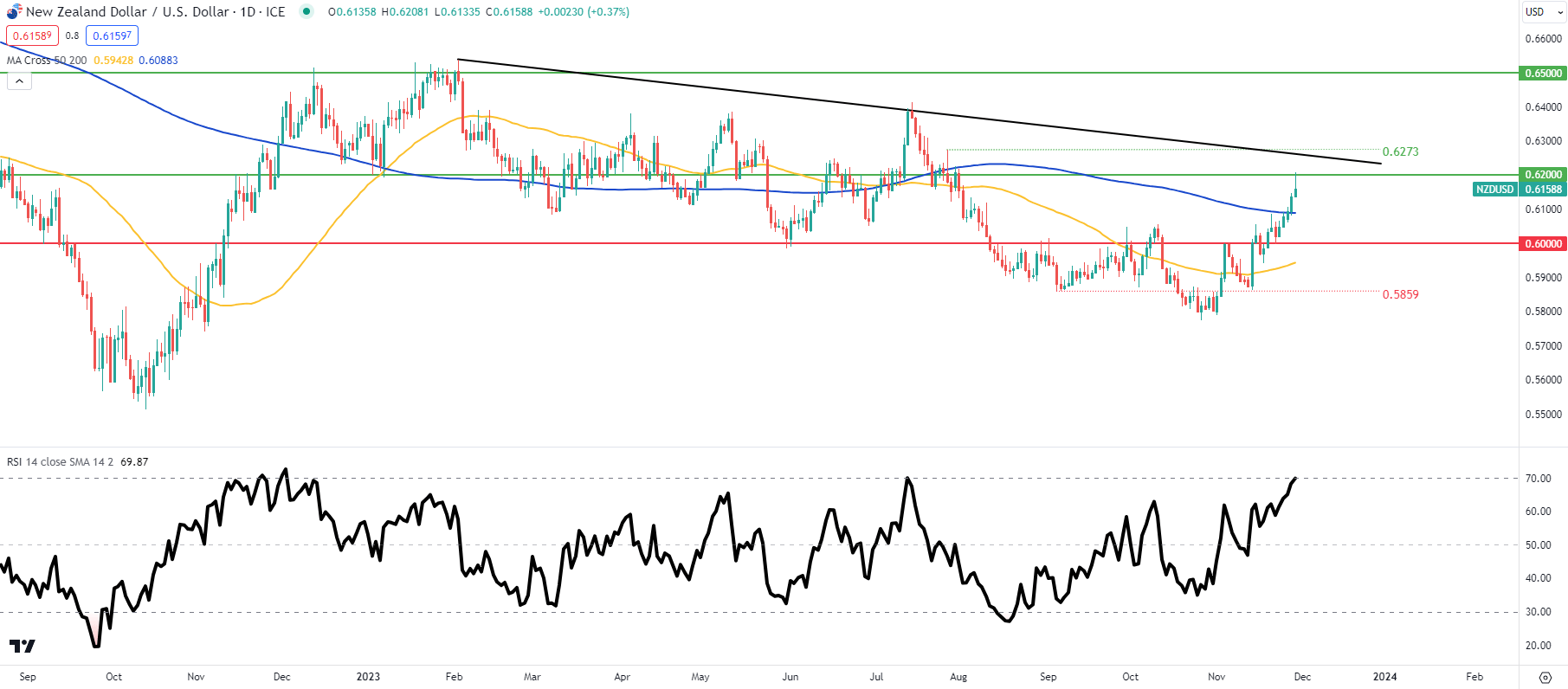

NZD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily NZD/USD price action shows the recent upside pairing back off the psychological resistance handle as the pair moves into overbought territory on the Relative Strength Index (RSI) . Traditionally, markets will be looking for a pullback, particularly if the current candle closes with a long upper wick but if a further dovish bias is enforced, there may be room for more NZD strength. Short-term directional bias heavily depends on USD moves but from a technical analysis standpoint, I favor some NZD weakness.

- Trendline resistance

- 0.6200

- 200-day moving average (blue)

- 0.6000

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently on AUD/USD , with of traders currently holding long positions.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course