USD/CAD ANLAYSIS & TALKING POINTS

- Moderating Canadian inflation unable to shake CAD bulls just yet.

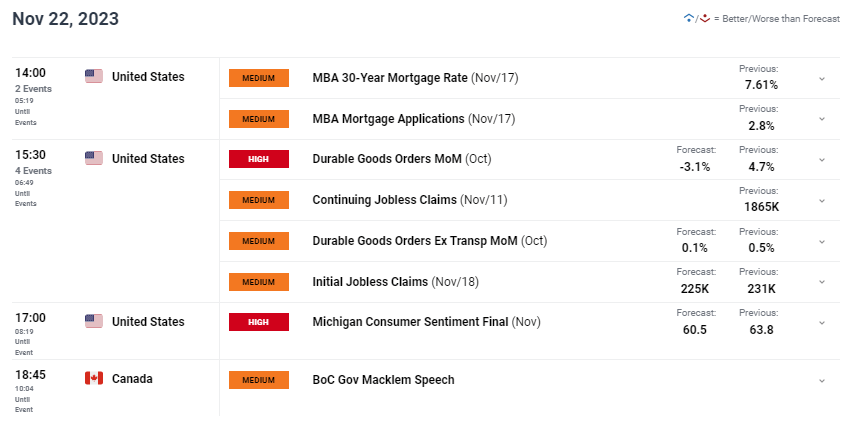

- US durable goods orders, consumer sentiment and BoC’s Macklem in focus later today.

- Will channel support hold firm once again?

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

The Canadian dollar did not veer from its recent base after yesterday’s Canadian CPI report and the FOMC minutes respectively. For those of you who missed the data, both headline and core inflation ticked lower and may prompt the Bank of Canada (BoC) to adopt a more neutral/ dovish outlook. From a US standpoint, the FOMC minutes were largely uneventful (to be expected) as market sentiment has changed drastically since the November announcement with recent economic data showing a slowing US economy. Today’s releases (see economic calendar below) may supplement this narrative with durable goods orders and consumer sentiment both set to fall significantly – weighing negatively on the USD .

USD/CAD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

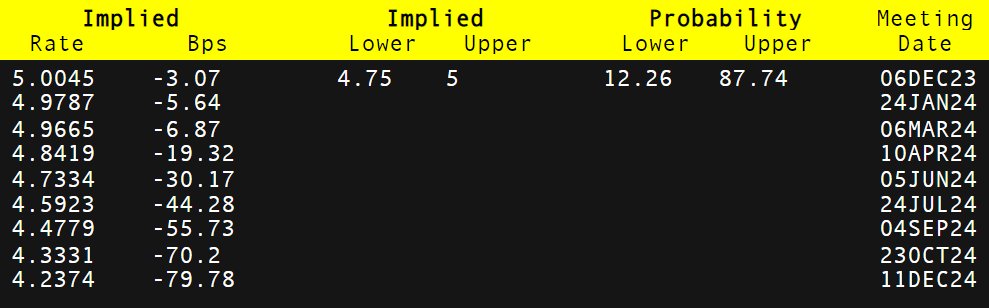

The BoC’s Governor Tiff Macklem is scheduled to speak later today and with his recent comments around minimal growth and now softening inflation, cautious messaging may be apparent. Currently, money markets anticipate toughly of cumulative rate cuts by December 2024 with monetary easing set to begin around April/June.

BOC INTEREST RATE PROBABILITIES

Source: Refinitiv

Crude oil will still play a major role for the loonie as markets keenly await the OPEC+ meeting this weekend to see whether or not they decide to extend their voluntary production cuts through to next year.

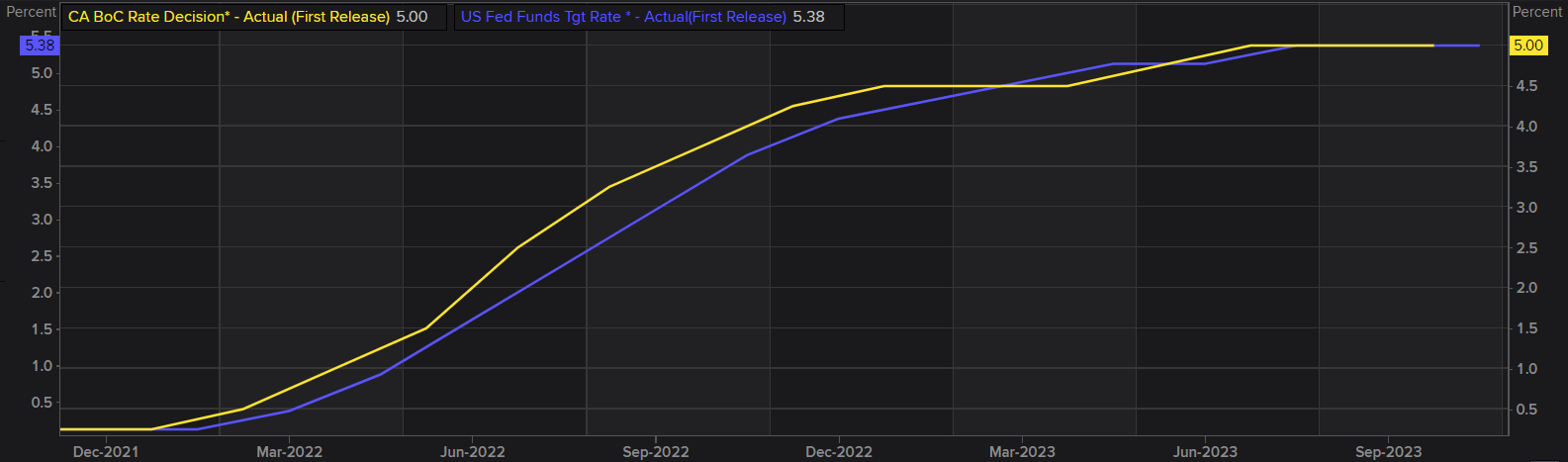

A worrying sign for CAD bulls is the most recent CFTC positioning that shows shorts increasing to its highest level since 2017. This may be due to the fact that the BoC were the first to begin their hiking cycle against the Fed (refer to graphic below) at a swifter pace therefore, markets could be expectant of a similar trajectory towards the downside.

BOC VS FED INTEREST RATE CYCLE

Source: Refinitiv

TECHNICAL ANALYSIS

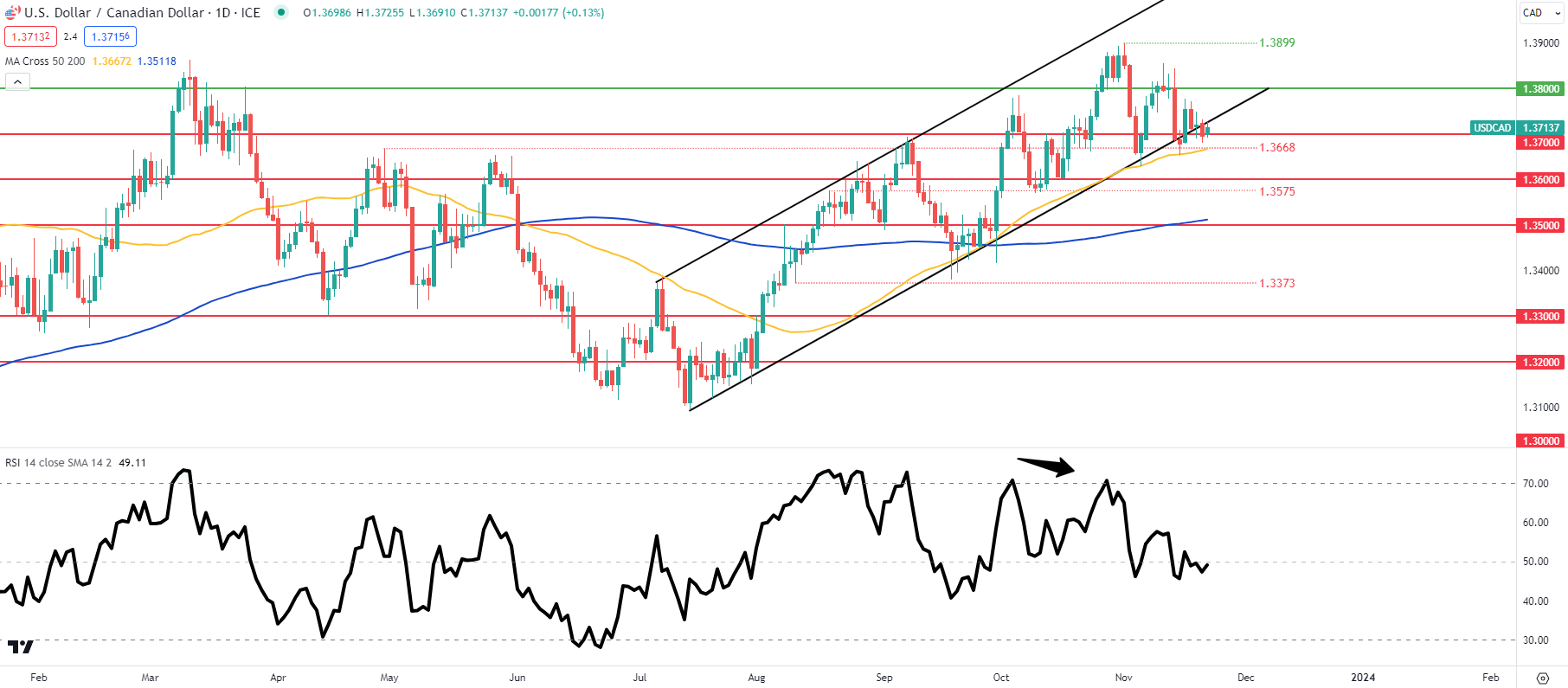

USD /CAD DAILY CHART

Chart prepared by Warren Venketas , IG

Daily USD/CAD price action shows the pair testing the long-term channel support zone. A weekly close below this region may prompt additional CAD strength. Fundamental data is critical at this juncture and will likely be cemented by the weekend’s decision by OPEC+. The Relative Strength Index (RSI) suggests indecision in the market and rightly so, meaning traders should exercise caution in the period.

- 1.3899

- 1.3800

- Channel support

- 1.3700

- 1.3668/50-day MA (yellow)

- 1.3600

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently net on USD/CAD , with of traders currently holding short positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course