Gold, Silver Analysis

- Gold eases after last week’s advance – quieter week on the economic calendar

- FOMC minutes and reports of a new phase in the Israel-Hamas war present potential catalysts

- Silver encounters a challenge at channel resistance

Gold Eases After Last Week’s Advance

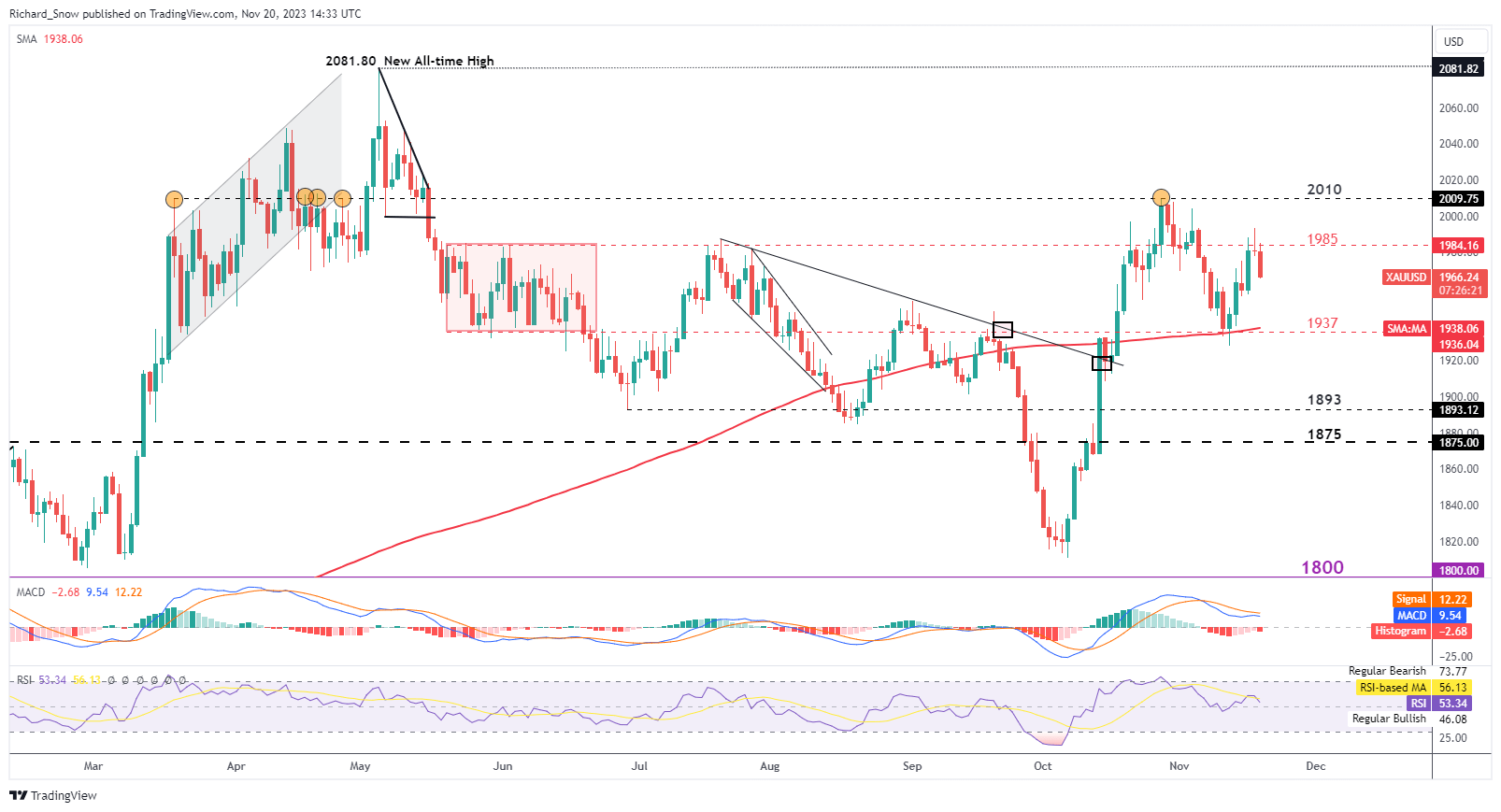

Gold rose last week to end a two-week run of losses but Friday’s price action laid the ground for a potential move lover this week. Friday’s extended upper wick revealed the early sign of a possible pullback developing at the start of this week.

Price action now heads lower, trading down from the $1985 level, with he $1937 level next in view – as support. The $1937 level is significant as it roughly coincides with the 200-day simple moving average (SMA).

In recent trading days, a weaker dollar and easing US yields (Treasuries) have helped prop up gold prices after hitting a low on November 13th – the day before that softer US CPI print that inspired a dollar selloff.

The FOMC minutes offer up a potential catalyst for the precious metal this week as far as it affects the dollar. Other than that it is a relatively quiet week however, a new phase in the Israel-Hamas war could see gold find it feet once more.

Source: TradingView, prepared by Richard Snow

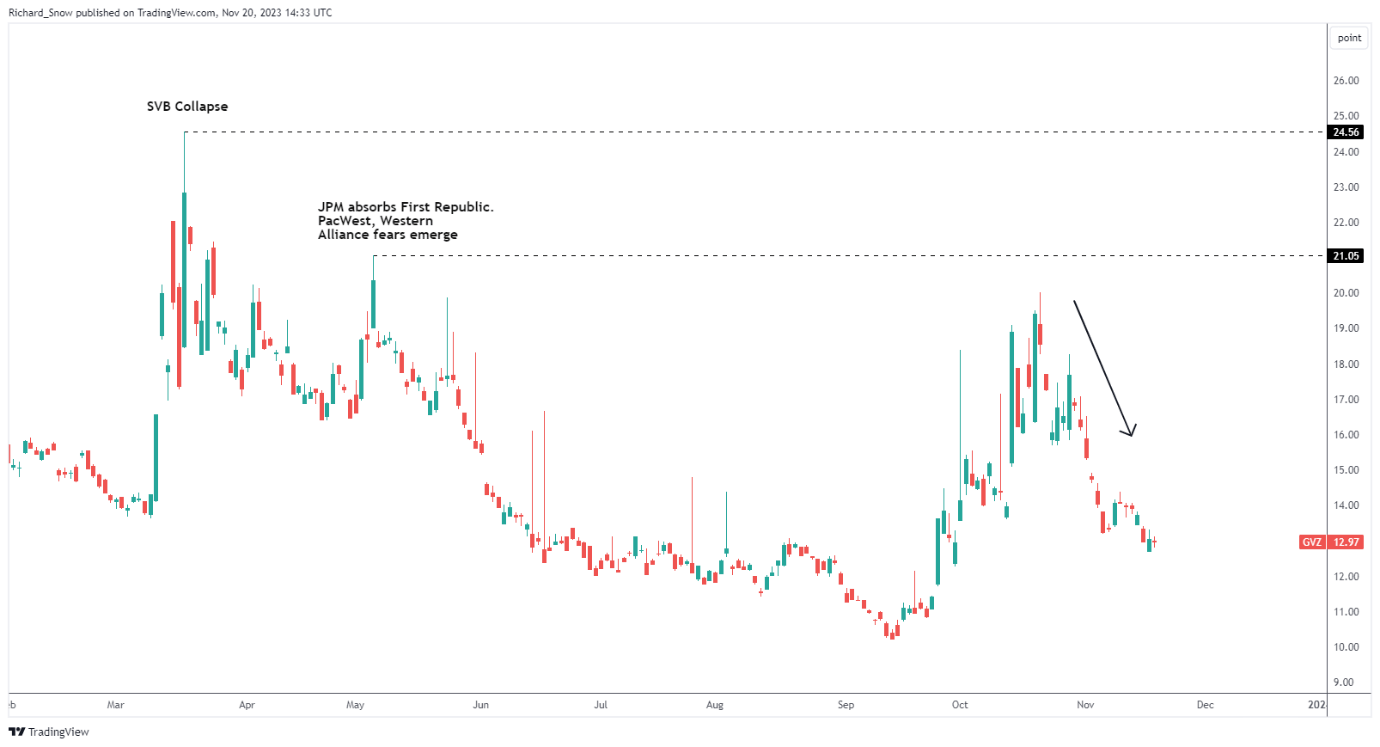

Expected 30-day gold volatility continues to drop off a cliff after a brief period of consolidation. The longer this trend continues gold is unlikely to spike higher like we saw at the start of the conflict, but the metal is still in a favourable position to capitalize on further USD selling and lower US yields.

30-Day Expected Gold Volatility (GVZ) Source: TradingView, prepared by Richard Snow

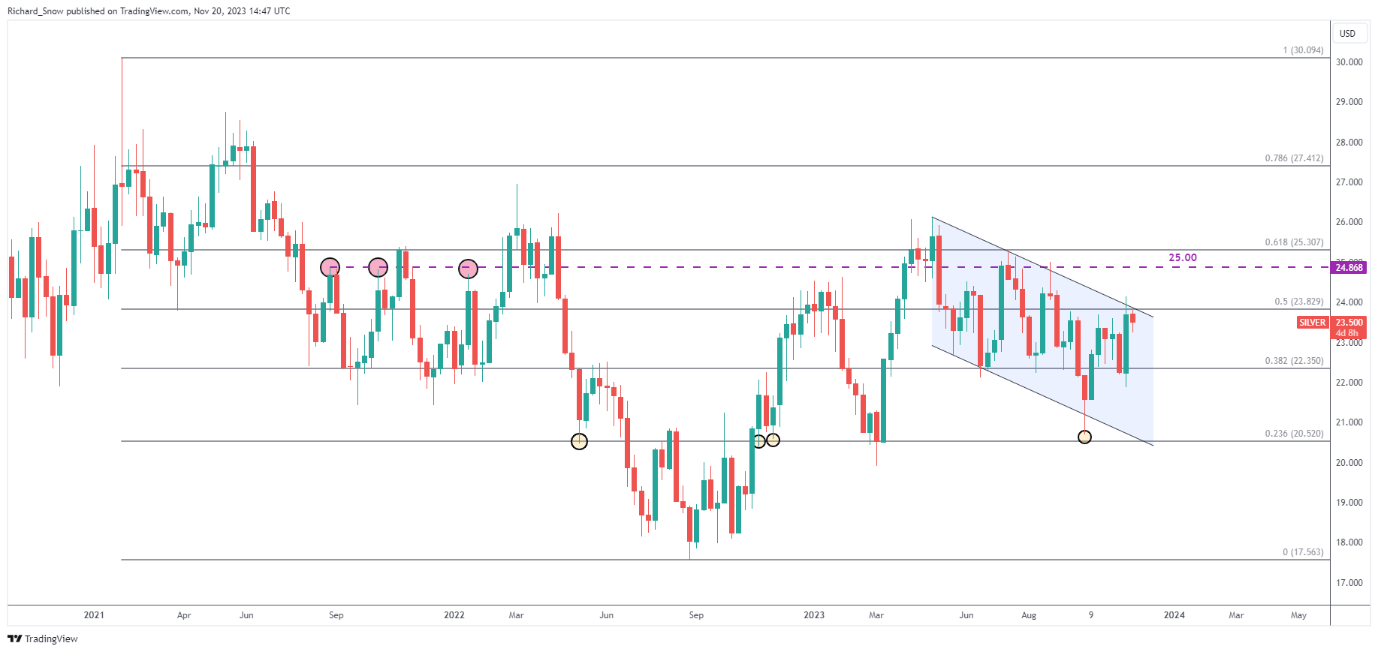

Silver Encounters a Challenge at Channel Resistance

Silver also posted an impressive week last week, rising up to channel resistance and the (less significant) 50% Fibonacci retracement. Nevertheless, the metal has started the week on the back foot, with a continued drop opening up $22.35 (38.2% Fib) as a possible level of support. A larger move sees channel support come into play at the 23.6% fib retracement , $20.52.

Source: TradingView, prepared by Richard Snow