MARKET WEEK AHEAD FORECAST: GOLD, US DOLLAR, EUR/USD, OIL

- U.S. Treasury yields retreated over the past few days, weighing on the broader U.S. dollar

- Meanwhile, gold prices , the Nasdaq 100 and EUR/USD rallied, breaching key technical levels during their move higher

- Few high-impact events are expected in the coming days, with a shorter trading week in the U.S. because of the Thanksgiving holiday

U.S. Treasury yields fell sharply last week after lower-than-expected U.S. inflation data coupled with rising U.S. jobless claims all but eliminated the likelihood of further monetary tightening by the U.S. central bank, giving traders the green light to begin pricing in more aggressive rate cuts for next year.

The downturn in yields boosted stocks across the board , propelling the Nasdaq 100 towards its July high and within striking distance of breaking out to the topside- a technical event that could have bullish implications for the tech benchmark upon confirmation.

The broader U.S. dollar, for its past, plunged almost 2%, with the DXY index sliding towards its lowest level since early September. Against this backdrop, EUR / USD blasted past its 200-day simple moving average, closing at its highest point in nearly three months.

Benefiting from declining rates and a battered U.S. dollar, gold (XAU/USD) surged over 2.0% for the week, edging closer to reclaiming the psychological $2000 threshold. Meanwhile, silver prices jumped 7%, but was ultimately unable to breach a key ceiling near the $24.00 mark.

In the energy space , oil (WTI) dropped for the fourth straight week, settling at its lowest point since mid-July. Traders should keep a close eye on near-term crude price developments, as pronounced weakness could suggest subdued demand growth linked to fears of a possible recession.

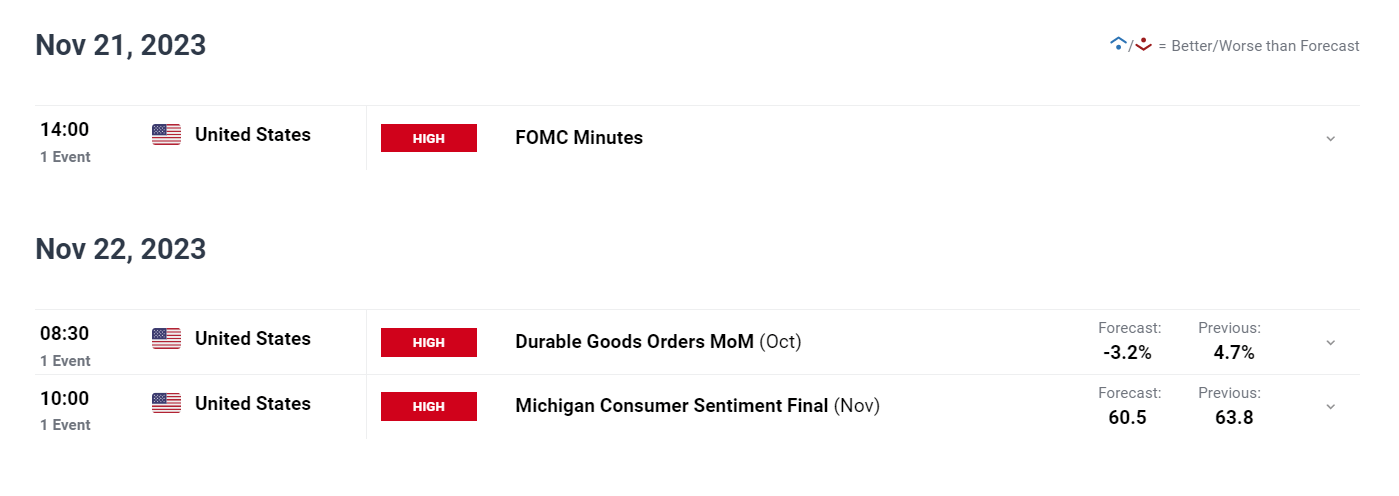

Looking ahead, the U.S. economic calendar will be devoid of major releases in the coming days, with a shorter trading week due to the Thanksgiving holiday. The absence of high-profile events could mean consolidation of recent market moves, paving the way for a deeper pullback in yields and the U.S. dollar. This, in turn, could translate into further upside for precious metals and risk assets.

For a deeper dive into the catalysts that could guide markets and create volatility in the near term, be sure to check out selected forecasts put together by the DailyFX team.

US ECONOMIC CALENDAR

FUNDAMENTAL AND TECHNICAL FORECASTS

Sterling has done well against the dollar in recent days, but hardly on its own merits.

USD/JPY continues to hover around the 150 mark ahead of Japanese CPI next week.

EUR/USD has racked up some hefty gains this week on the back of a US dollar sell-off. Can the euro keep the move going by itself next week?

The rise in US equities has been fast and sharp, spurred on by weaker US data. Few scheduled risk events next week leave the door open for further gains.

Gold and silver enjoyed an excellent week but now face technical hurdles to start the new week. Will US data help the metals overcome their challenges and keep the bullish rally alive?

This article focuses on the U.S. dollar, exploring the technical outlook for key FX pairs such as EUR/USD, USD/ JPY , GBP/USD , and AUD/USD . The piece also analyzes crucial price levels to monitor in the upcoming trading sessions.

Article Body Written by Diego Colman, Contributing Strategist for DailyFX.com