Oil (Brent, WTI) Analysis

- (EIA) US storage data reveals massive inventory builds as many fear weaker demand

- Softer economic data continues to flow in for the US ( NFP , CPI , retail sales)

- IG client sentiment offers few clues on potential price path despite net-long positioning

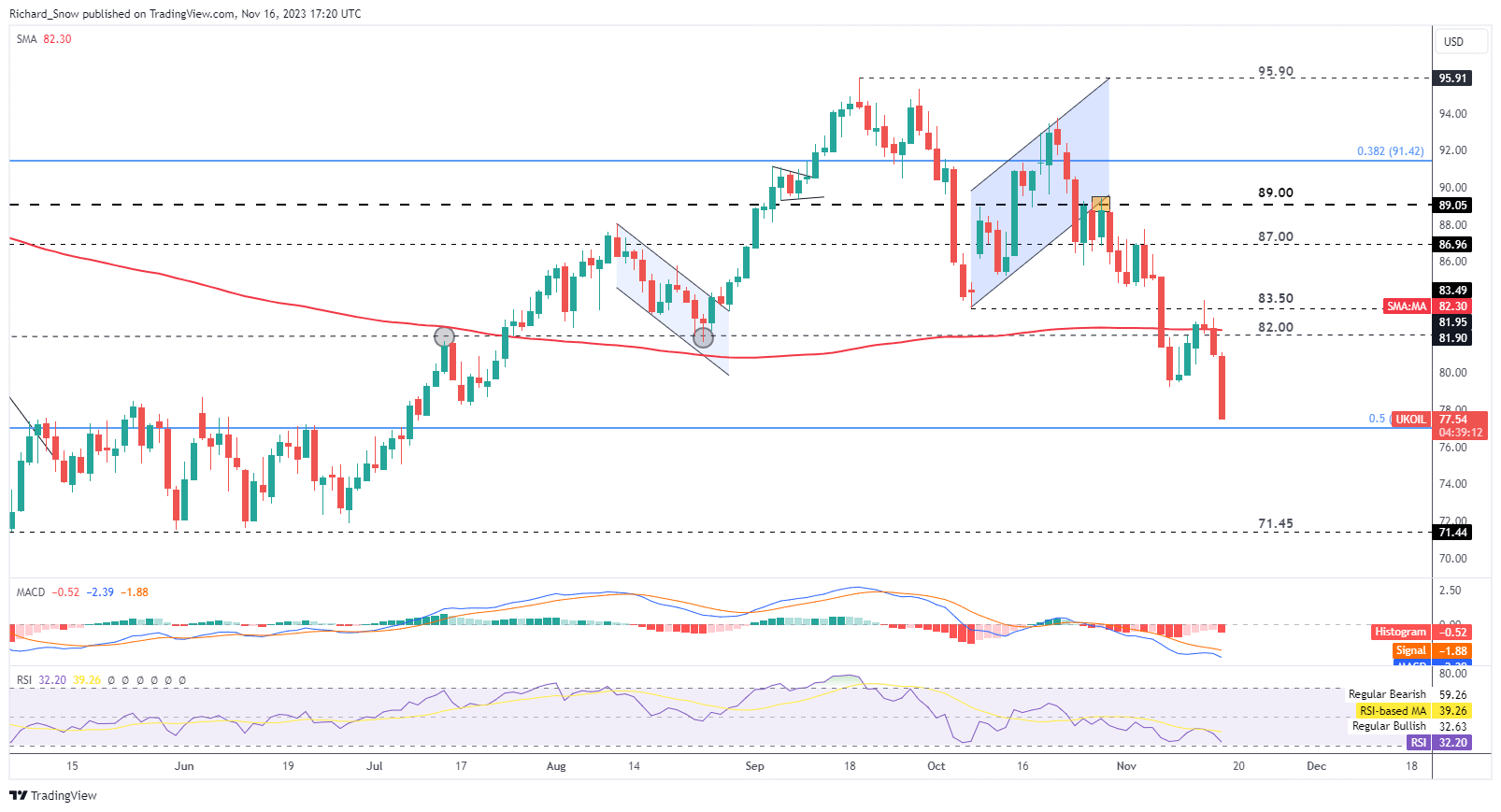

Brent Crude Under Even More Pressure After Stock Builds

Delayed and current EIA data for the week ending the 3rd and 10th of November revealed massive increases in crude storage, weighing heavily on the price. Deteriorating economic data has illuminated the path for lower oil prices but the recent accumulation of oil stocks has simply exacerbated the current sell-off.

Brent now trades around the 50% Fibonacci retracement of the broader 2020 to 2022 advance and well below the $82 and psychological $80 mark. The next level of support appears all the way at $71.45 but the market is likely to enter oversold territory before nearing such a level with resistance back at $82.

Oil prices have declines as the global growth slowdown continues to weigh on economic activity and we are even seeing a deterioration in relatively well performing US data.

Source: TradingView, prepared by Richard Snow

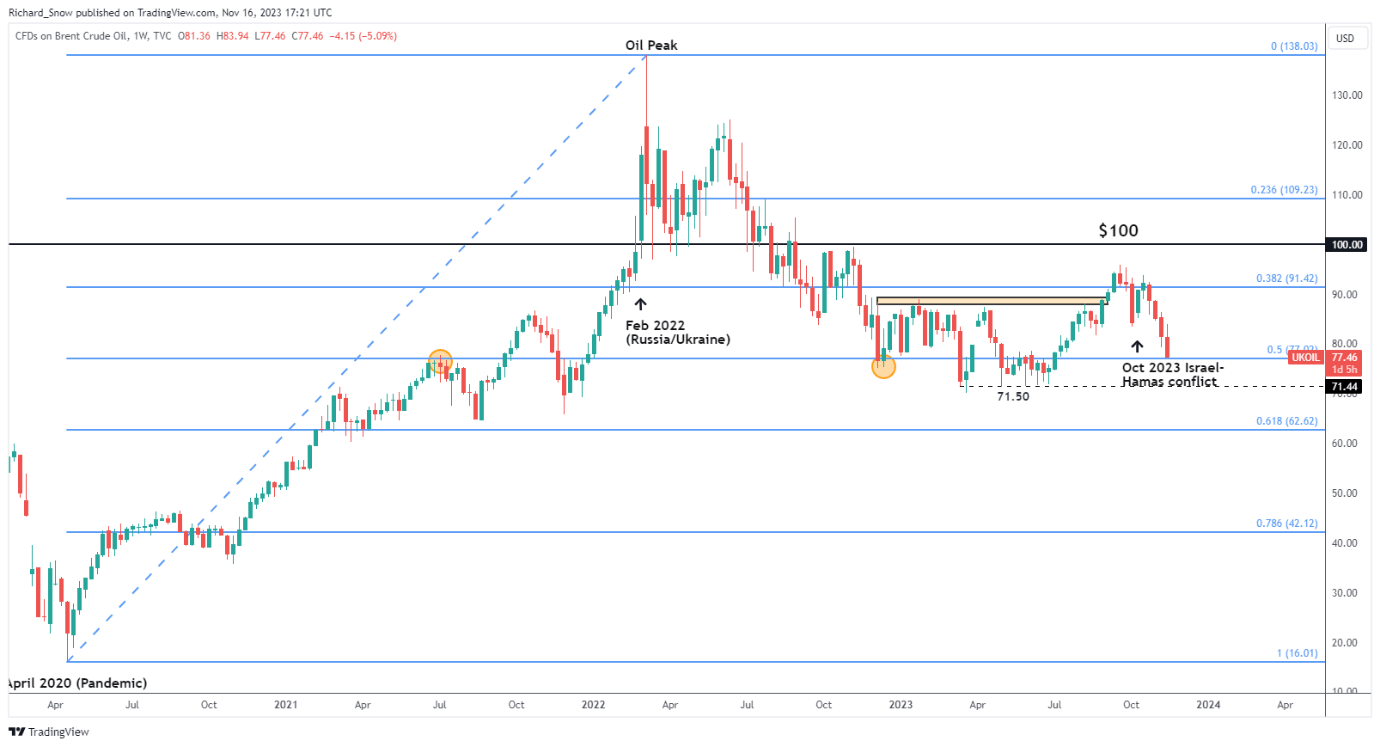

The weekly chart shows the major 2020 to 2022 advance along with the many geopolitical shocks of the last three, nearly four years from the pandemic to the Russian invasion of Ukraine and now the conflict in the middle east and worsening data. $71.50 is a key level and OPEC may already be weighing up the possibility of further supply cuts.

Source: TradingView, prepared by Richard Snow

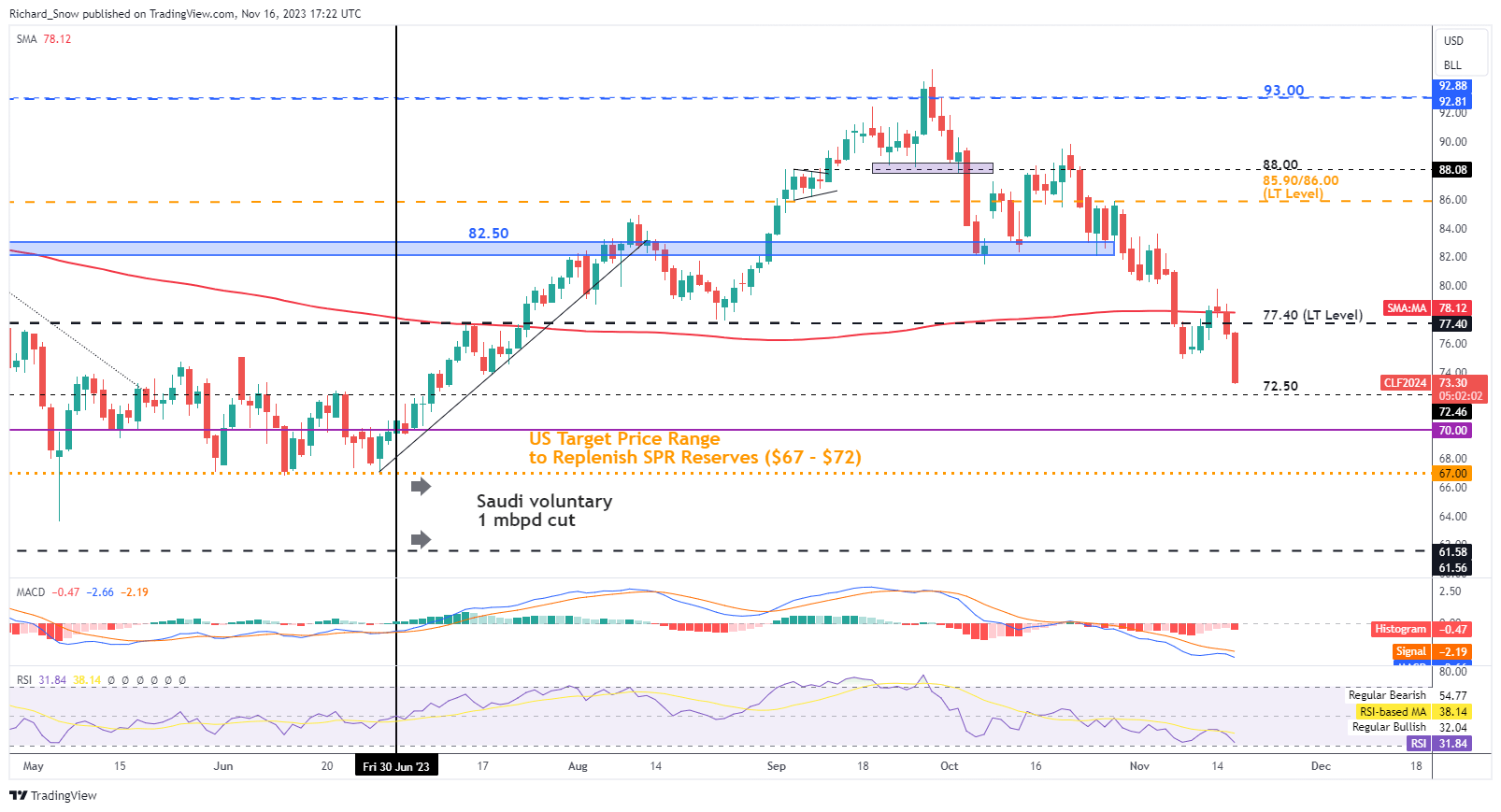

The WTI crude chart reveals a very similar move but shows the near-term level of support at $72.50 followed by the Biden administrations former target band of $67 to $72 to replenish SPR levels – something that was later stated would take years to conduct.

Source: TradingView, prepared by Richard Snow

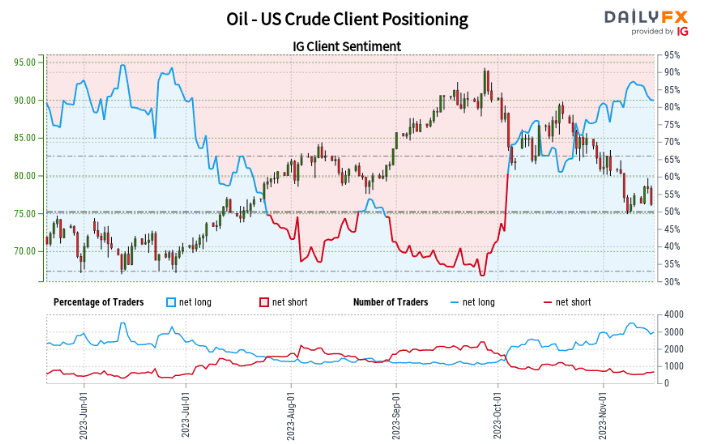

IG Client Sentiment Mixed Despite Net-Long Positioning

with the ratio of traders long to short at 4.98 to 1.

, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias.