AUD/USD ANALYSIS & TALKING POINTS

- Australian wage growth the highest since 2009.

- Focus now shifts to US PPI and retail sales data.

- AUD/USD bulls look to break 0.65 handle.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar remains buoyant this morning after yesterday’s rally post- CPI that saw the greenback sell off. Optimistic Chinese economic data (see economic calendar below) supplemented Australian wage growth figures that grew at its fastest pace since 2009. If this translates through to sticky inflation, the Reserve Bank of Australia’s (RBA) may need to tighten monetary policy further.

Precious and base metals are broadly higher adding to AUD upside today ahead of US PPI and retail sales. PPI is generally seen as a leading indicator that could give an indication as to inflation (CPI) going forward. If actual data falls in line with estimates, the US dollar may weaken further.

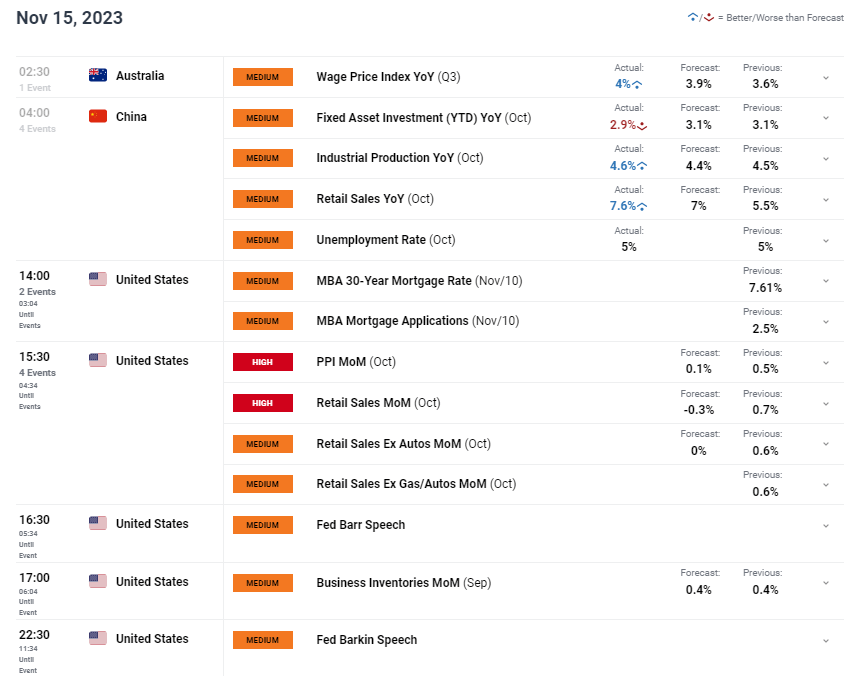

AUD/ USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

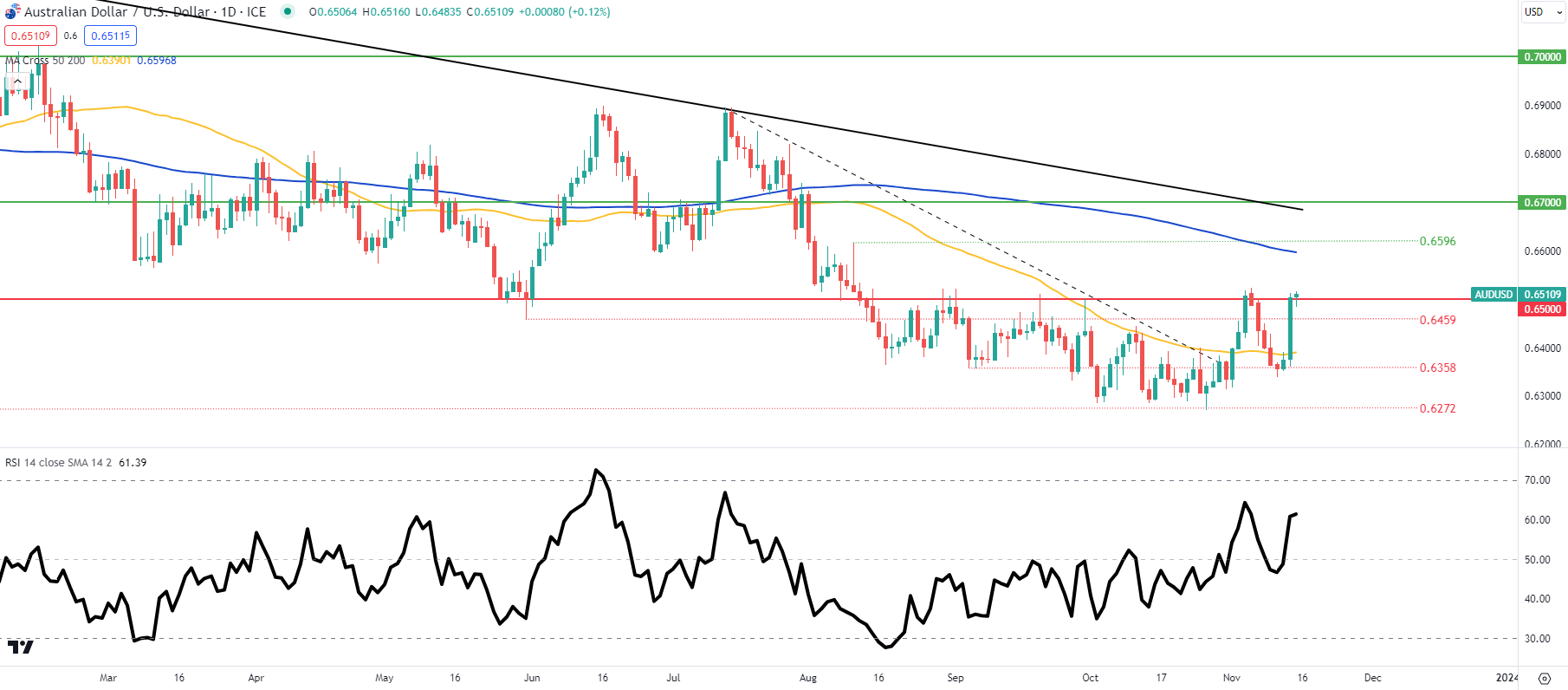

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

AUD/USD price action shows the pair back at the psychological level once again. The level has held firm since mid-August but may be giving way soon. The next zone under scrutiny will be the 200-day moving average (blue) from a bullish perspective but a close above the November swing high is needed before bulls can push the pair higher.

- 0.6596

- 200-day MA

- 0.6459

- 50-day MA

- 0.6358

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net on AUD/USD , with of traders currently holding long positions.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course