Market Week Ahead: US Dollar, Gold, GBP/USD, EUR/USD, Cryptocurrencies

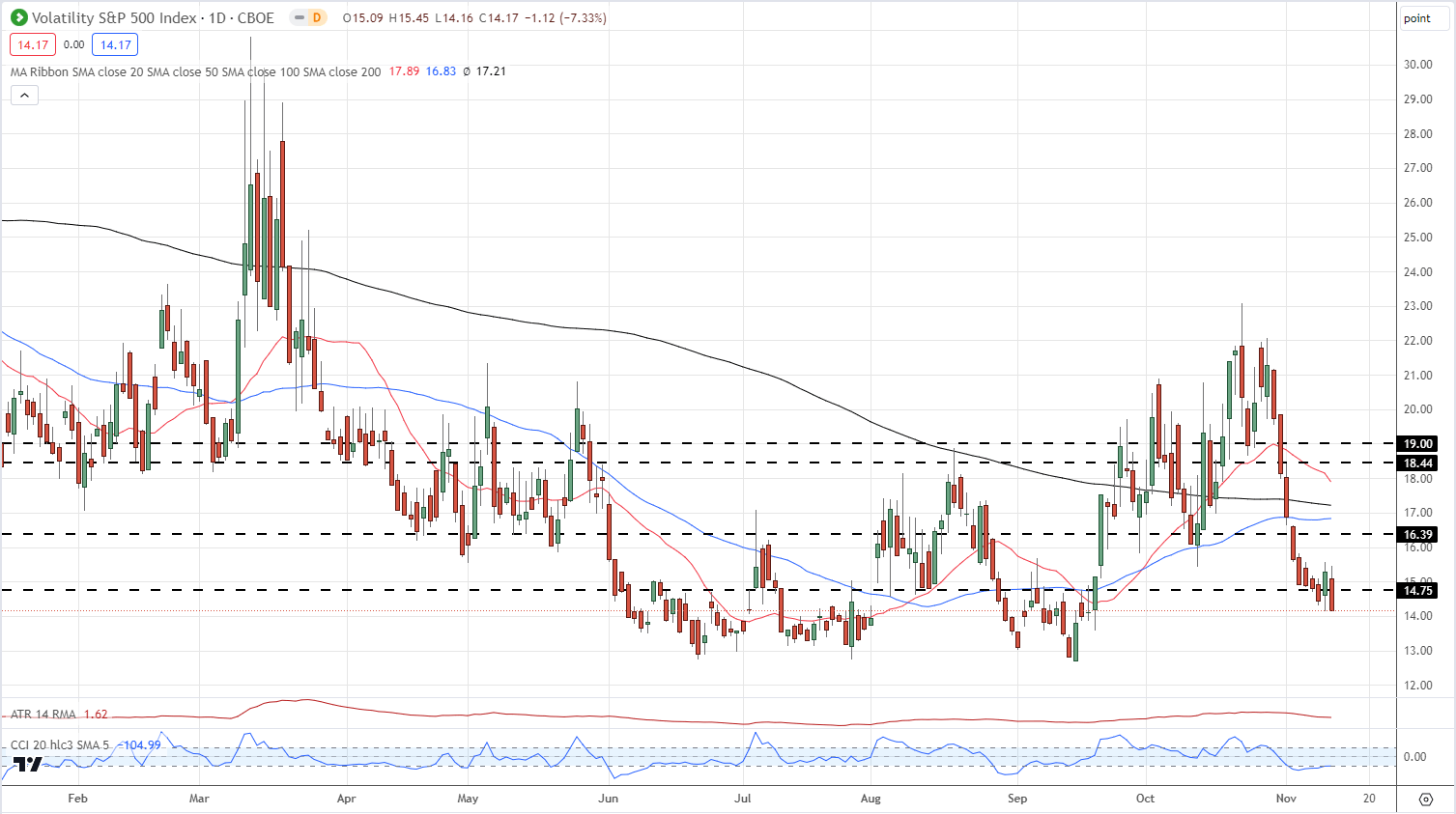

A strong end to the week with risk markets popping higher going into the weekend. Equity markets reclaimed Thursday’s minor losses and continued to push ahead, with the S&P 500 and the Nasdaq 100 both printing fresh multi-week highs. The VIX ‘fear gauge’ fell by over 7% on Friday and is back testing lows last seen in mid-September.

VIX Daily Chart

In the alternative asset class space, a wide range of cryptocurrencies surged on increased volume. Talk that a Bitcoin spot ETF may be launched before November 17th underpinned the recent Bitcoin rally, while ETH jumped on news that BlackRock had applied to the SEC for an Ethereum spot ETF. Two months ago the total cryptocurrency market capitalization stood at USD1.0 trillion, today that market capitalization is at USD1.42 trillion.

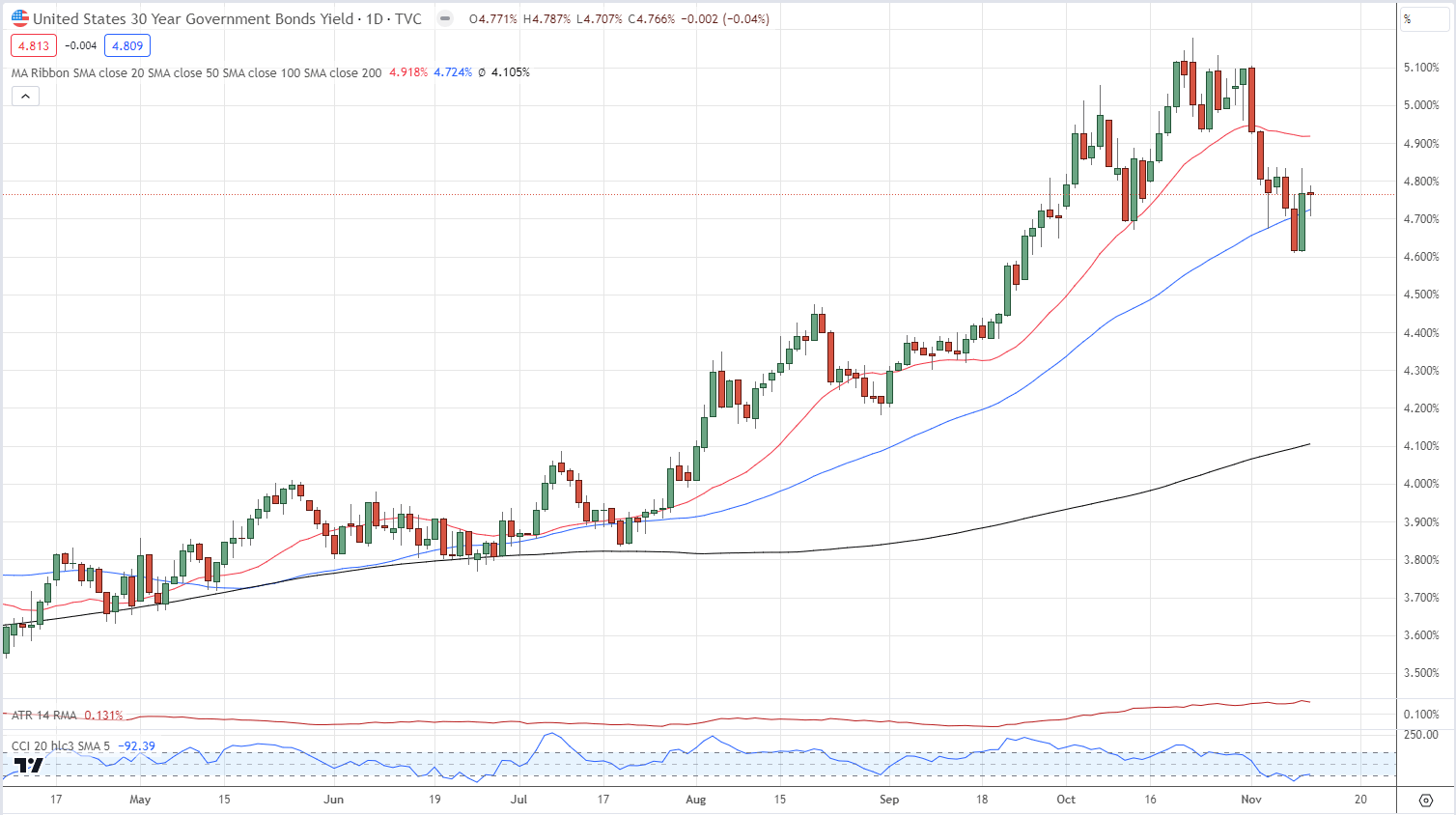

The US dollar had a confusing week as US Treasury yields slumped, then jumped and ended the week near the week’s high. Chair Powell’s hawkish comments that he was not sure if the Fed had enough to temper inflation sent bond yields higher, while an extremely weak US 30-year bond auction pushed yields even higher. The US dollar followed moves in the US bond market and ended the week on a high.

US Treasury 30-Year Yield

Gold had a tough week and ended at a fresh three-week low as investors moved away from safe-haven assets and into a variety of risk-on markets. Higher bond yields also weighed on the precious metal which is now testing a range of technical levels.

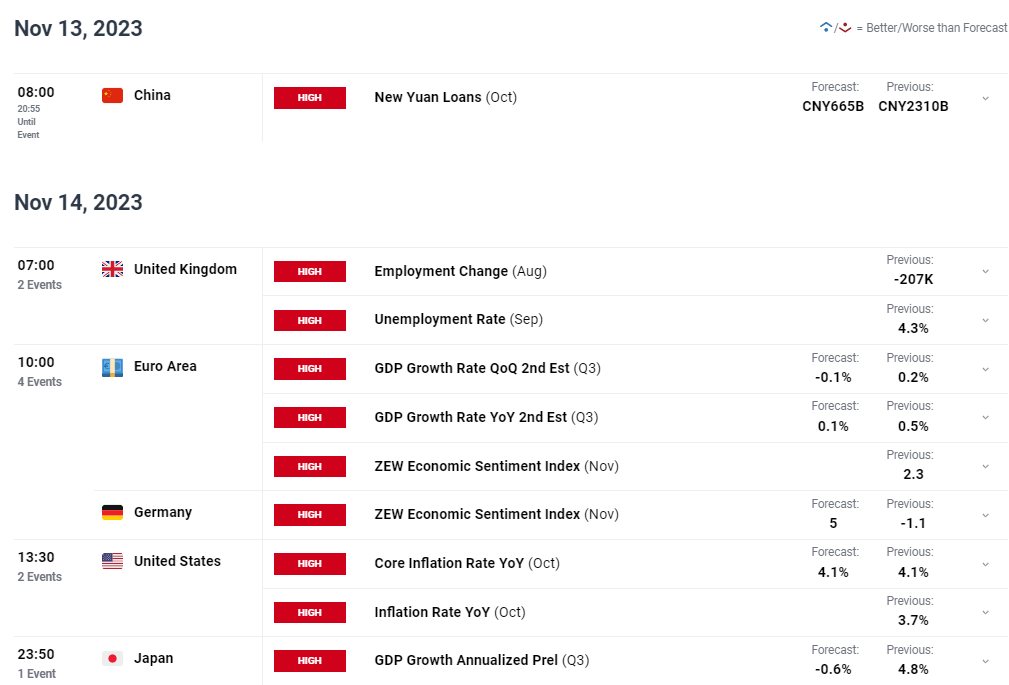

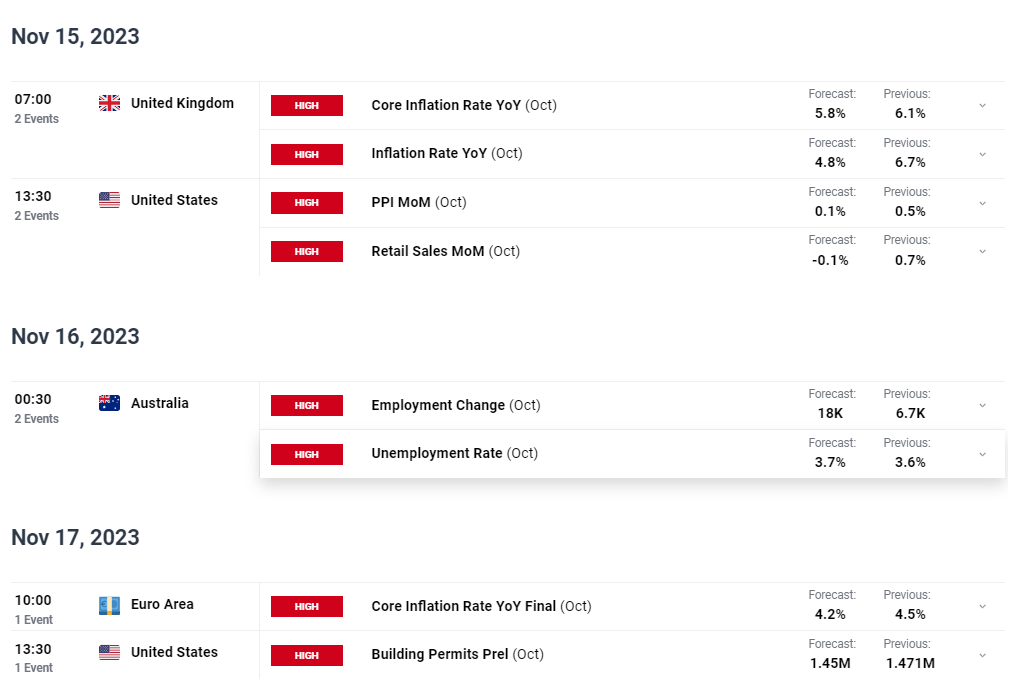

Next week the economic calendar has a range of high-impact economic releases with the latest UK, Euro , and US inflation reports the standouts. Chinese New Yuan Loans over the weekend will also be worth watching as the world’s second-largest economy looks to try and boost faltering growth .

For all market-moving economic data and events, see the

Technical and Fundamental Forecasts – w/c November 13th

The British Pound remains vulnerable to further losses against the US dollar but continues to move back towards a multi-year high against the Japanese Yen . GBP/AUD set for a six-day rally.

EUR/USD prices enter the week facing multiple economic data reports including US and euro area CPI. Euro area headline inflation is expected to drop sharply to 2.9% from 4.3% which could weigh negatively on the euro should this actualize.

Ethereum ETF Potential sparks a renewed crypto rally. According to reports the SEC is set to decide on Spot Bitcoin ETF applications by the 17th. If true are BTC and ETH about to explode?

Gold and silver have witnessed respective declines as the ‘war premium’ dissipates and the dollar recovers lost ground on the back of Powell’s hawkish comments.

The October U.S. inflation report will take center stage in the upcoming week. An upside surprise in CPI numbers might boost the greenback across the board, while lower-than-expected figures could have the opposite effect.