EUR/USD, PRICE FORECAST:

- EUR/USD Hovers Around the 1.0700 Level as Market Participants Seek Clarity.

- Technicals Hint at a Potential Run Toward the 1.0800 Handle As we Await Comments from Central Bank Presidents Lagarde and Powell.

- IG Client Sentiment Shows Majority of EURUSD Traders Remain Long.

- To Learn More About Price Action , Chart Patterns and Moving Averages , Check out the DailyFX Education Section .

The Euro appears to be gaining some traction against the Greenback of late. The 1.0700 handle however has proved stubborn with EURUSD unable to maintain gains once crossing the threshold. Markets continue to remain optimistic that the Fed are done with rate hikes despite mixed messages from Fed Policymakers.

ECB BULLETIN

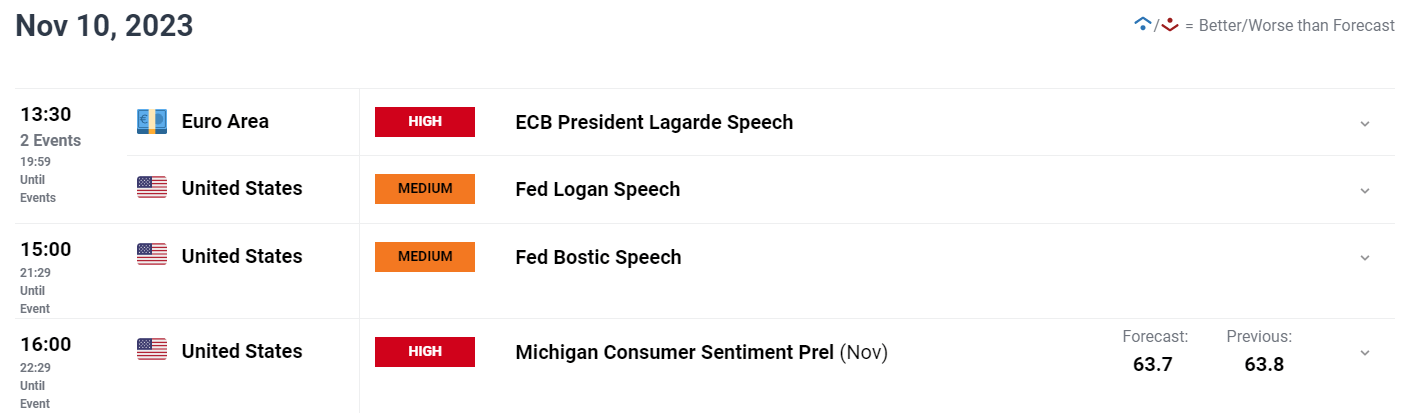

This morning brought the release of the ECB Economic Bulletin which weighed slightly on the Euro sending EURUSD below the 1.0700 handle. There was not a lot that surprised here with the key takeaways being that the economy is likely to remain weak for the remainder of 2023. The ECB further elaborated that subdued foreign demand and tighter financing conditions are increasingly weighing on investment and consumer spending.

FED POLICYMAKERS

The lack of high impact data has left markets searching for a catalyst this week. Fed policymakers have provided mixed messaging this week and this has resulted in the mixed and choppy price action for the majority of the week. Following hawkish comments from policymakers Kashkari and Bowman today we heard from Rafael Bostic who struck a more dovish tone.

We do have comments from ECB President Christine Lagarde and FED Chair Jerome Powell later today. Market participants will be hoping that some clarity will be provided by the respective Central Bank heads ahead of some US data tomorrow.

TECHNICAL OUTLOOK AND FINAL THOUGHTS

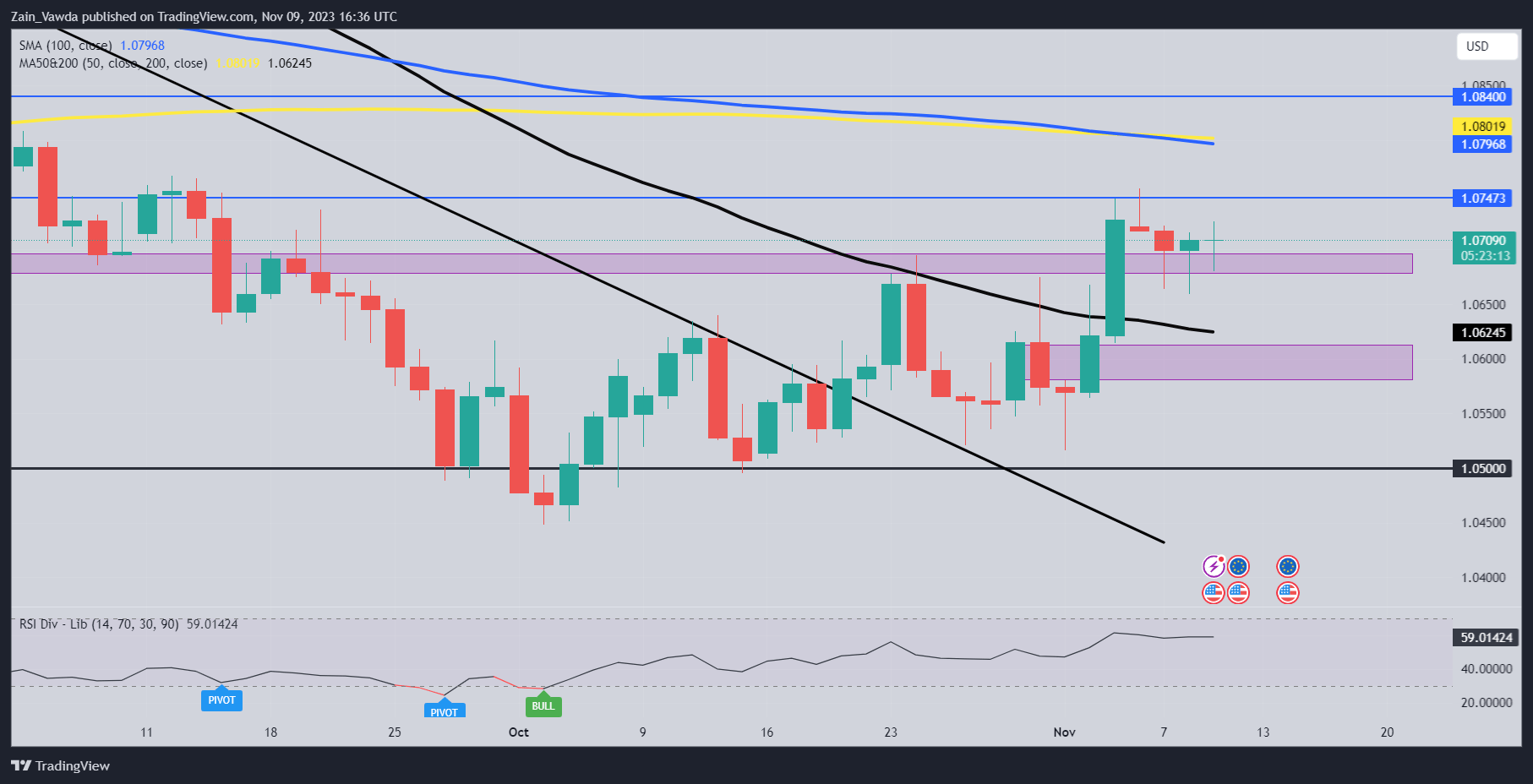

Looking at EURUSD and the overall conditions remain pretty much the same. No signs of major escalation in both the Russia-Ukraine and Middle East conflict are likely to keep safe haven demand at bay. This has certainly been the case of the last week and has weighed on the US Dollar and DXY which has struggled to regain its bullish momentum.

I do however like the way price action is setting up at the moment following yesterday's hammer candlestick close on the Daily timeframe. Price appears to have found support around the 1.0680-1.0700 support area which leads me to believe that a test of resistance at 1.0750 and a potential run toward the 1.0800 handle may be on the way. A renewed selloff in the US Dollar would help and may come to fruition with Fed Chair Powell speaking later today and potentially US data tomorrow.

- 1.0750

- 1.0800

- 1.0840

- 1.0680-1.0700

- 1.0627

- 1.0550

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently Net-Long on EURUSD, with 57% of traders currently holding LONG positions. Give the contrarian view adopted at DailyFX toward Client Sentiment, is EURUSD destined to drop back toward the 1.0600 handle?