USD/CAD Analysis

- BoC minutes largely dismissed by markets due to recent dismal Canadian economic data.

- Fed Chair Jerome Powell speech in focus later today.

- USD/CAD holds around the 1.38 handle as bearish divergence threatens.

USD/CAD Fundamental Backdrop

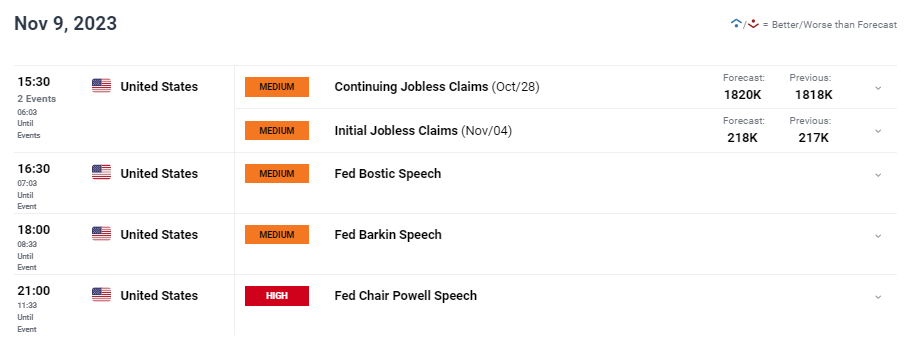

USD/CAD remains cautious after rallying this week on the back of some hawkish Fed speak as well as a steady and continuous build-up of weak Canadian economic data including PMI and building permits. This relatively quiet week will likely peak today in terms of volatility as Fed Chair Jerome Powell is scheduled to speak on monetary policy (see economic calendar below).

USD / CAD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Markets ‘dovishly’ repriced Fed rate hike expectations after the Non-Farm Payroll (NFP) miss last week which could have been a slight overreaction in my opinion. Additional incoming data will be required to properly gauge the status of the US economy. Mr. Powell may well leave the door open for potential hikes if necessary and pushback against talk of rate cuts.

From a Canadian perspective, the Bank of Canada (BoC) Summary of Deliberations were released last night and contained hawkish messaging. This report di little to negate CAD downside due to subsequent economic data that was released. Some key statements are shown below:

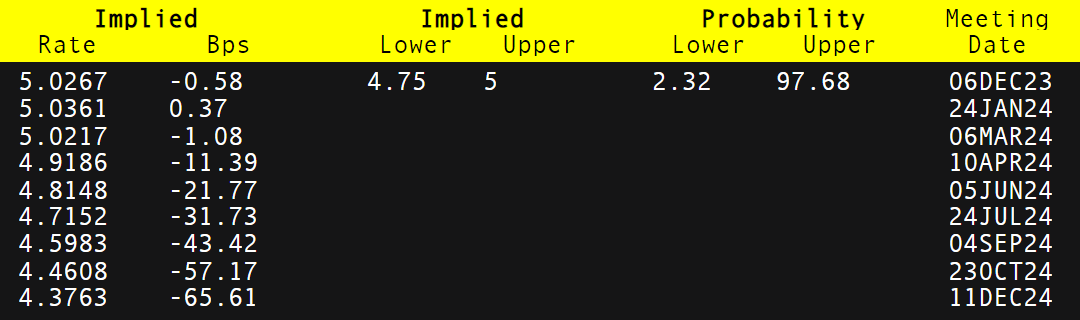

The December rate announcement (according to money market pricing) looks to be in favor of a rate pause at with almost certainty (refer to table below) with the first round of rate cuts projected around June 2024.

BANK OF CANADA INTEREST RATE EXPECTATIONS

Source: Refinitiv

Crude oil prices (a key Canadian export) has been a major contributor to loonie weakness of recent but with OPEC+ likely concerned around the sharp decline, an extension of voluntary production cuts may be announced in due course – a potential silver lining for CAD bulls.

TECHNICAL ANALYSIS

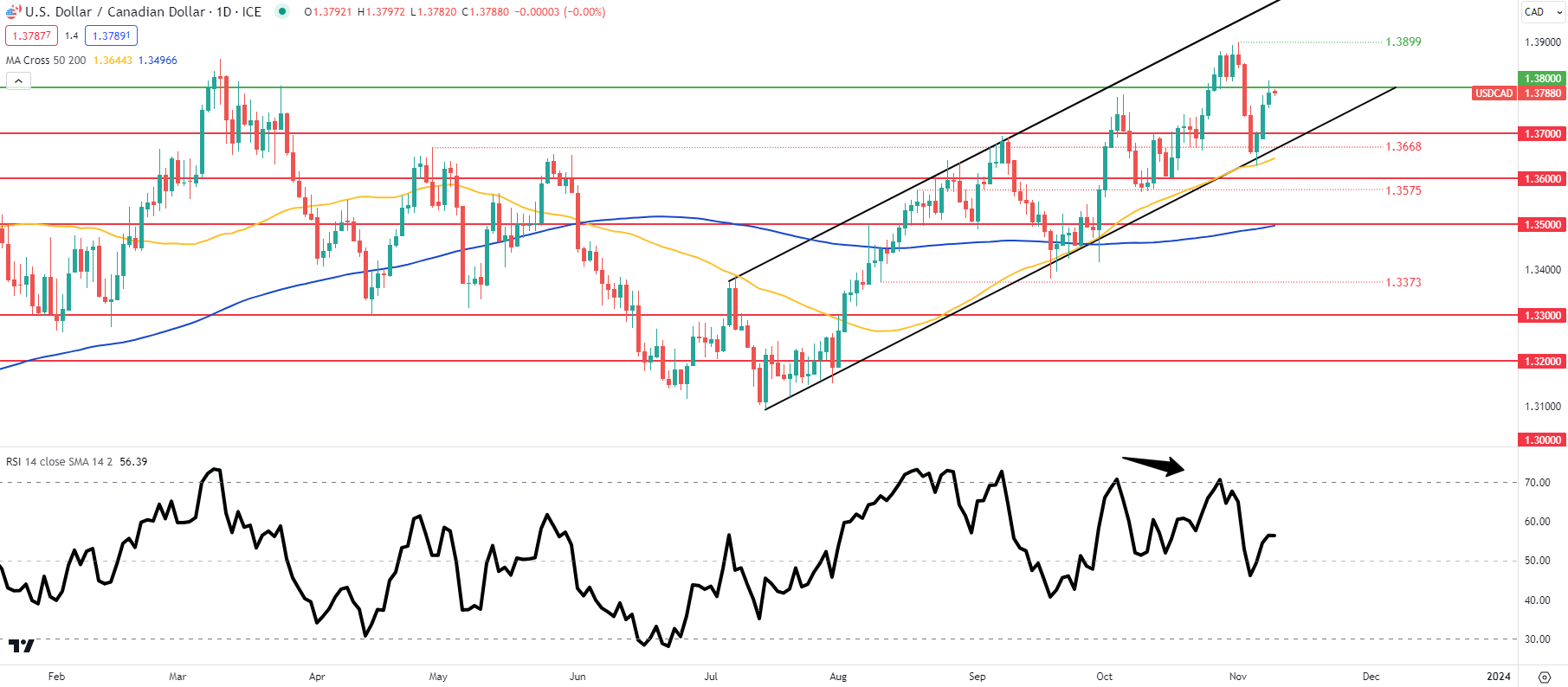

USD/CAD DAILY CHART

Chart prepared by Warren Venketas , IG

USD/CAD price action above shows apparent bearish/negative divergence on the daily chart with the Relative Strength Index (RSI) exhibiting lower highs while USD/CAD prices print higher highs. The pair remains within the longer-term upward trending channel but could see a retest of channel support should crude oil prices push higher alongside a possible weaker US dollar .

- 1.3899

- 1.3800

- 1.3700

- 1.3668/Channel support

- 50-day MA (yellow)

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently prominently on USD/CAD , with of traders currently holding long positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course