Downward Dollar Gains Momentum, Testing the Monthly Low

The US dollar has been on a downward trajectory since early July, declining as nervousness in the job market surfaced via a rising unemployment rate. This, coupled with marginally lower inflation data has contributed to an overwhelming view that the Fed will look to September to get its rate cutting cycle underway, possibly using Jackson Hole as the platform to communicate such a preference.

Markets anticipate just under 100 basis points (bps) worth of rate cuts are likely to materialize before the end of the year which may be complicated by the US election in November. In an attempt to demonstrate the central bank’s independence, there is a risk that the Federal Open Market Committee (FOMC) may opt to keep rates unchanged in November, leaving just September and December as live meetings. Risk appetite continues to recover after the 5th of August volatility spike, warranting a closer look at major currency pairs and the Aussie dollar in particular.

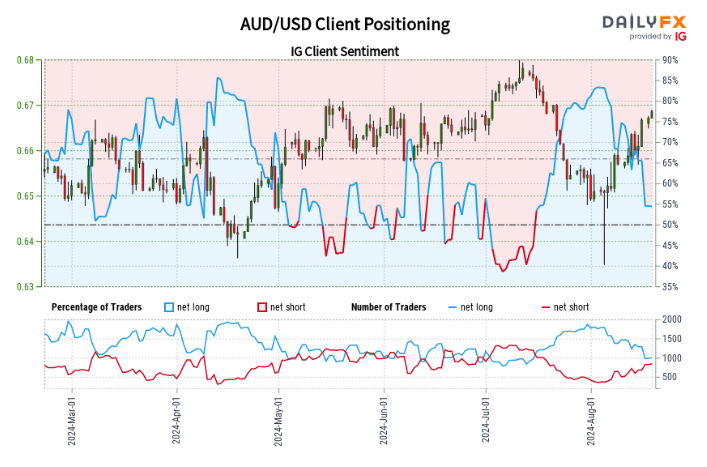

Retail trader data indicates that 53.75% of traders hold net-long positions, with a long-to-short ratio of 1.16 to 1.

- Net-long traders: 2.65% increase

- Net-short traders: 4.65% increase

- Net-long traders: 31.03% decrease

- Net-short traders: 65.32% increase

Our analysis typically adopts a contrarian stance to crowd sentiment. The current net-long trader position suggests potential continued decline in AUD/USD prices. However, the reduction in net-long positions compared to yesterday and last week indicates a possible reversal of the current downward trend, despite the overall net-long trader stance.

Richard Snow

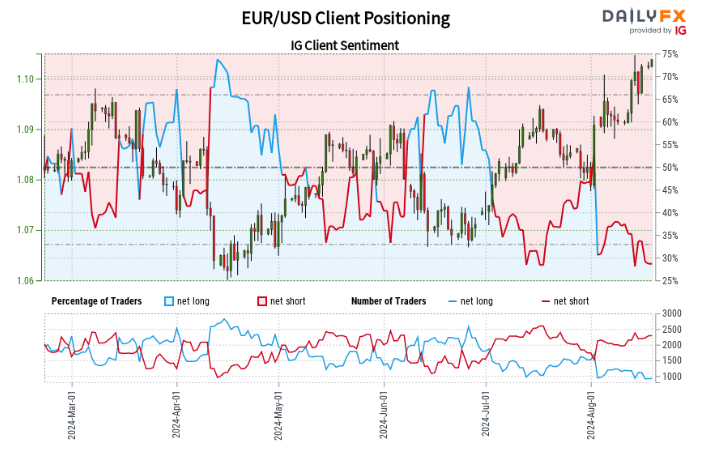

Retail trader data shows 29.24% of traders in net-long positions, with a short-to-long ratio of 2.42 to 1.

- Net-long traders: 2.91% increase

- Net-short traders: 0.09% increase

- Net-long traders: 19.90% decrease

- Net-short traders: 13.24% increase

Using a contrarian approach to crowd sentiment, the predominance of net-short traders suggests potential continued rise in EUR/USD prices. The current positioning is less net-short than yesterday but more net-short than last week, resulting in a mixed EUR / USD trading outlook .

Richard Snow

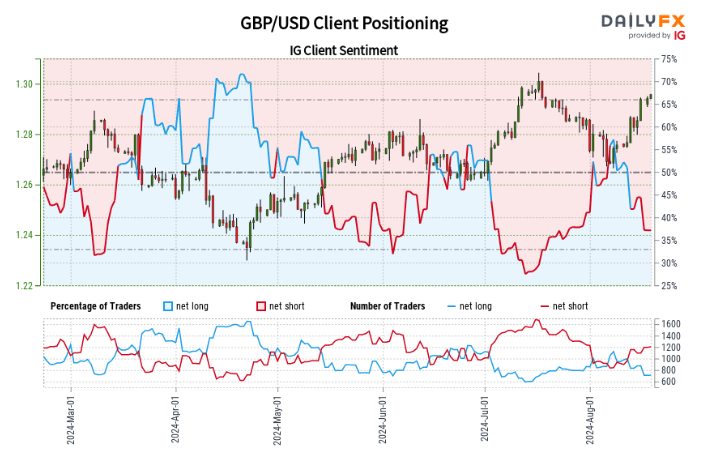

Retail trader data reveals 37.53% of traders hold net-long positions, with a short-to-long ratio of 1.66 to 1.

- Net-long traders: 1.25% increase

- Net-short traders: 0.08% increase

- Net-long traders: 26.57% decrease

- Net-short traders: 32.10% increase

Applying our contrarian view to crowd sentiment, the prevalence of net-short traders indicates potential continued increase in GBP/USD prices. The current positioning is less net-short than yesterday but more net-short than last week, resulting in a mixed GBP /USD trading outlook.

Richard Snow